In today’s fast-paced world, investing wisely is key to securing a financially stable future. Whether you’re planning for retirement, saving for a large purchase, or simply growing your wealth, understanding how your money grows over time is crucial. That’s where the Investment Calculator comes in. This tool allows you to calculate the growth of your investments, taking into account initial investments, monthly contributions, interest rates, tax rates, and the investment period.

Investment Calculator

What is the Investment Calculator?

The Investment Calculator is an interactive tool designed to help you understand how your investments will grow over time. By entering some simple details, such as your initial investment, monthly contributions, interest rates, and investment period, the tool calculates how much your investment will be worth in the future—both before and after tax.

The results are displayed in two key sections:

- Investment Summary: This section shows a high-level overview of your final investment value, total contributions, total interest earned, and total tax paid.

- Investment Growth Table: A detailed month-by-month breakdown of how your investment grows over time, including the contributions you make and the total investment value.

How to Use the Investment Calculator

1. Input Your Investment Details

To get started, you need to enter the following information into the calculator:

Initial Investment (₱):

This is the amount of money you’re starting with. If you have an existing sum that you’d like to invest, enter that here.

Monthly Contribution (₱):

This is the amount of money you’ll be adding to your investment every month. Regular monthly contributions can greatly boost the growth of your investment, thanks to compound interest.

Annual Interest Rate (%):

This is the rate at which your investment will grow each year. The interest rate can vary depending on the type of investment you’re considering. Enter the rate as a percentage (e.g., 5% interest would be entered as 5).

Investment Period (Years):

How long do you plan to keep your money invested? The longer you invest, the more you can benefit from compound interest. Enter the number of years you plan to invest.

Tax Rate (%):

Investments may be subject to taxes. This input allows the calculator to account for taxes that may be deducted from your returns. For example, a 20% tax rate means that 20% of your earnings will be paid as tax.

Once you’ve entered all the details, click the Calculate button to view the results.

2. Understanding the Results

After hitting the Calculate button, the calculator will display two key sections: the Investment Summary and the Investment Growth Table.

Investment Summary

This section summarizes your investment details in a simple format:

- Final Investment Value (after tax):

This is the total amount of money you’ll have at the end of the investment period, after deducting taxes. It includes both the principal (initial investment + monthly contributions) and the returns generated from the interest rate. - Total Contributions:

This is the sum of all the money you’ve invested throughout the entire period. It’s the total of your initial investment and all monthly contributions over the years. - Total Interest Earned:

The interest earned on your initial investment and monthly contributions, calculated based on the annual interest rate. It’s the difference between the Final Investment Value and Total Contributions. - Total Tax Paid:

This represents the amount of taxes you’ll pay based on the Tax Rate and the Interest Earned. It’s calculated from the interest earned and deducted from your total returns.

Investment Growth Table (Monthly)

This table provides a month-by-month breakdown of how your investment grows. For each month of the investment period, it shows:

- Month: The number of months that have passed since the start of the investment.

- Total Contributions (₱): The sum of your initial investment and monthly contributions made up to that month.

- Monthly Interest (₱): The total monthly interest

- Investment Value (₱): The total value of your investment at the end of the month, including interest, before tax deductions.

Investment Growth Table (Yearly)

This is the yearly summary of the Contributions, Interest, and Investment Value. You can picture here how your money grows every year.

How the Calculator Works: The Math Behind It

Understanding how the calculator arrives at its results can help you make better decisions about your investment strategy. Here’s how the tool performs the calculations:

Compound Interest Calculation

The calculator uses the compound interest formula to calculate how your investment grows over time. Compound interest means that you earn interest not only on your initial investment but also on the interest that accumulates over time.

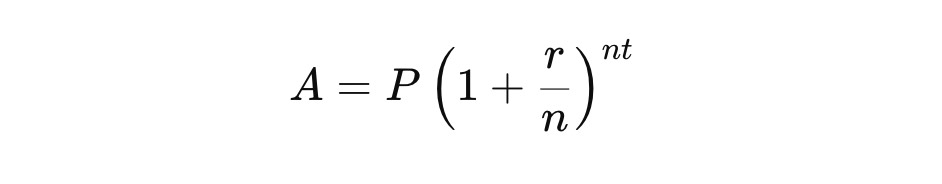

The formula for compound interest is:

Where:

- A = the amount of money accumulated after n years, including interest.

- P = the principal (initial investment).

- r = annual interest rate (as a decimal).

- n = number of times the interest is compounded per year.

- t = number of years the money is invested.

In this calculator, the interest is compounded monthly, so the formula adapts to reflect monthly compounding. For each month, the interest is calculated and added to the principal, increasing the investment’s value.

Tax Consideration

Once the final value of the investment is calculated, the calculator accounts for taxes. The tax rate is applied to the interest earned on the investment. The formula to calculate the amount of tax paid is:

Tax Paid = Interest Earned X Tax Rate

After the tax is deducted, the final investment value (after tax) is displayed.

Example

Let’s say you invest ₱100,000 as an initial investment, contribute ₱5,000 monthly, have an annual interest rate of 5%, and plan to invest for 10 years with a tax rate of 20%. The calculator will:

- Calculate the compounded growth of your initial investment and monthly contributions over 10 years.

- Determine how much interest you’ve earned on your total investment.

- Deduct the tax (20%) from the interest earned and provide you with the final investment value after tax.

Why Use This Calculator?

- Simplicity: The calculator simplifies complex investment calculations. With just a few inputs, you can get detailed results on how your money will grow over time.

- Flexibility: Whether you’re just starting your investment journey or planning for long-term growth, you can easily adjust the inputs to see different scenarios.

- Visualization: The month-by-month breakdown helps you track your investment progress, showing you exactly how your money grows each month.

- Tax Awareness: The tax feature allows you to account for the reality of taxes, providing you with a more accurate picture of your investment’s performance.

This Investment Calculator is an invaluable tool for anyone looking to understand the impact of compound interest on their investments. Whether you’re planning for retirement, saving for a home, or simply growing your wealth, this calculator gives you the insights you need to make informed financial decisions.

By adjusting the input values based on your financial goals and investment preferences, you can experiment with different strategies and see how your investment grows over time.

Other Calculators:

- Loan Calculator with Amortization Table

- Overtime Pay and Total Salary Calculator

- 50/30/20 Monthly Budget Calculator