Ever think about the amount you will get from SSS after you retire? Well firsthand, you need to know that in order for you to have this benefit, contribution amount and time are the variables in order for you to weigh if you will have a pension or not. So in this article, we will be telling you all about the monthly pension and how you can compute for it.

Before going deeper with the calculation, we first need to know the types of people who are eligible for the monthly pension:

Read Also: How to compute SSS Maternity benefits

- A member who is 65 years old whether employed or not has paid at least 120 monthly contributions before the semester of the retirement.

- A member who is 60 years old separated from employment or ceased to be self-employed and has paid at least 120 monthly contributions prior to the semester of retirement.

How to Compute SSS Monthly Pension

Of course, there are steps you need to follow prior to computing how much you can get for the monthly pension once you decide to retire.

Step 1: Check your Contributions

First of all, you need to know how much contributions you are putting monthly into your SSS profile. You can do this by asking your Human Resources Team (HR) if you are employed, or you can call SSS directly and ask for your contributions via a representative. Alternatively, you can search for it online if you have registered for the online viewing of your transactions.

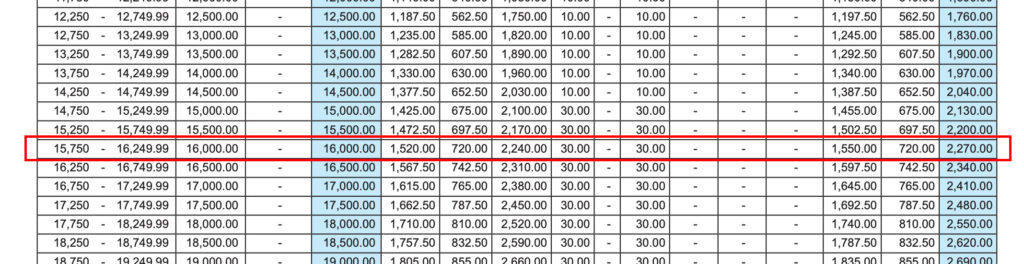

I will be posting the table of contributions below and here are things you need to remember:

- In the left most part where you can see Range of Compensation, that is where you should look to see where your salary falls.

- In the 2nd column, you will see the Average Monthly Salary Credit (AMSC) and this is where to look if you are to compute for your pension so you need to take special note of this.

- ER is Employer’s Contribution

- EE is Employee’s Contribution

- ER and EE combined is the total contribution you will make for SSS (if you are employed).

This is the updated SSS contribution table for Employed SSS members, check the complete and updated SSS Contribution Table.

Step 2: Compute Monthly Pension

Once you know how much you put in, it is now time to compute the maximum pension you can receive once you retire.

For example, you are receiving P16,000.00 monthly for your salary. If you will look at the SSS monthly contribution table, your employer’s contribution (ER) will be P1,550 and your contribution (EE) will be P720 for a total of P2,270 for a month.

Sample Computation using 3 SSS Formula with 12 years of contribution

Using SSS Formula No.1

Monthly Pension = 300 + (20% x AMSC*) + (2% x AMSC) x (CYS** – 10);

or Sum of P300 + 20% of the (AMSC) + 2% of (AMSC) for each credited year of service in excess of 10 years.

So in this case, if we are to follow the values above:

Monthly Pension = P300 + (20% of AMSC first 10 years) + (2% of AMSC (2 years))

Monthly Pension = P300 + (20% x 16, 000) + (2% x 16, 000 x 2)

Monthly Pension = P300 + 3, 200 + 640

Monthly Pension = P4, 140.00

Using SSS Formula No.2

Monthly Pension = 40% x AMSC

Monthly Pension = 40% of AMSC

Monthly Pension = 40% x 16, 000

Monthly Pension = P6, 400.00

Using SSS Formula No.3

Minimum pension (P1,200 if with at least 10 Credited Years of Service or P2,400 if with at least 20 Credited Years of Service)

Comparing all of the formulas, it is clear that you get the highest amount with the 2nd formula, correct? Well with that being said, in order to have the 3rd formula to be the formula for your monthly pension, these are the points you need to remember:

- 12-year contributors are the only ones who are to have those kinds of formulas

- If self-employed, it would be better to contribute for the maximum if you have extra money in order to get the best benefits

- You cannot be granted monthly pension if you have not given at least 10 years contribution or 120 months total contribution

- If less than the said amount, you will receive lump sum benefit not pension

So now you know how to compute for the monthly pension, it is just right to continue your contribution to yield a bigger pension. What you need to do now is to continue working and continue contributing and it can promise you a big yield in the future when you are too old to work.

SSS monthly Pension Frequently Ask Questions (FAQs)

Who is eligible for the SSS monthly pension?

To be eligible, a member must have at least 120 monthly contributions and must be 60 years old and no longer working (for voluntary members) or 65 years old (for employed members).

How is the SSS monthly pension calculated?

The pension is based on the member’s Average Monthly Salary Credit (AMSC), the number of credited years of service, and other factors. SSS uses a formula that includes the AMSC and the number of contributions.

Can I receive the pension while still employed?

Yes, if you reach the age of 65, you are entitled to the pension even if you are still employed.

How often do I receive the SSS pension?

Pensioners receive their pension monthly via a designated bank account.

What is the minimum pension amount?

The minimum monthly pension is PHP 2,000, provided you have at least 120 monthly contributions.

Can I get a lump sum instead of a monthly pension?

Yes, if you have fewer than 120 contributions, you are eligible for a lump sum payment instead of a monthly pension.

When can I start receiving my pension?

If you stop working, you can apply for your pension at 60 years old. Otherwise, it will automatically begin at 65 years old.

What happens if I die before receiving my pension?

If a member passes away before claiming their pension, the survivor’s pension can be claimed by qualified beneficiaries, such as the spouse or dependent children.

How can I apply for my SSS pension?

You can apply online through the My.SSS portal or visit the nearest SSS branch. Ensure that you meet the age and contribution requirements.

Disclaimer: The information provided here is for general informational purposes only and is not intended as legal, financial, or official advice. For accurate and up-to-date details on SSS benefits, requirements, and processes, please refer to the official Social Security System (SSS) website or contact SSS directly. The content may change based on policy updates or revisions. We recommend verifying with the proper authorities to ensure accuracy.

More Helpful tutorials from EfrenNolasco.com

- Everything you need to know about the New Postal ID

- How to Register to BDO Online Banking

- How to Pay Smart Bills Online

- How to Book Online in Cebu Pacific

- How to enroll on PNB Online Banking

REFERENCES:

- SSS Retirement Benefits (https://www.sss.gov.ph/retirement-benefit/)

Sir, what AMSC will be used for the computation of sss pension? Will it be the current AMSC or the average of the last 5 years of AMSC? In my case, my last 5 years includes AMSC of 16,000 for 2017 to 2019, 20,000 for 2019 to 2021 and 25,000 for current.