Are you looking to grow your investments, plan for the future, or simply understand how compound interest works? Our Compound Interest Calculator is here to help you calculate the growth of your investment over time. Whether you’re an investor, student, or entrepreneur, this tool is a valuable asset in understanding how your money can work for you.

Compound Interest Calculator

What is Compound Interest?

Compound interest is the process by which interest earned on an initial investment is added to the principal, allowing the interest itself to earn interest over time. This creates exponential growth, unlike simple interest, where the interest is only calculated on the principal amount.

Compound Interest Formula

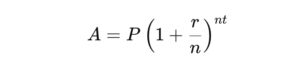

The formula for compound interest is:

Where:

- A is the final amount, including interest.

- P is the principal (initial investment).

- r is the annual interest rate (decimal).

- n is the number of times interest is compounded per year.

- t is the time in years.

By plugging these variables into the formula, the compound interest calculator helps you predict your investment’s future value, making it easier to plan for long-term financial goals.

Why is Compound Interest Important?

Compound interest is crucial for growing wealth over time. Here’s why:

- Maximizing Returns: The more frequently interest is compounded (monthly, quarterly, etc.), the more you’ll earn over time. This is why compound interest is often referred to as the “eighth wonder of the world.” It’s a powerful tool to turn small investments into substantial sums.

- Long-Term Investment Growth: Compound interest is most effective when applied to long-term investments. The longer the investment period, the more significant the impact of compounding becomes.

- Building Wealth: For retirement planning, real estate investments, or even a simple savings plan, compound interest can help you grow your wealth passively.

How to Use the Compound Interest Calculator

Using the Compound Interest Calculator is straightforward. Here’s how it works:

- Enter the Principal Amount (P): This is the initial sum of money you plan to invest or save. For example, PHP 10,000.

- Input the Interest Rate (r): This is the annual interest rate, expressed as a percentage. For instance, 5% per year.

- Select the Time Period (t): Decide how many years you plan to invest. The longer the period, the greater the potential for your money to grow.

- Choose the Compounding Periods (n): This refers to how often interest is applied to your balance. Common options are:

- Annually (once a year)

- Quarterly (4 times a year)

- Monthly (12 times a year)

- Daily (365 times a year)

- Click on “Calculate”: The calculator will display the final amount after compounding the interest, as well as the total interest earned.

Understanding the Results

Once you’ve entered your information, the Compound Interest Calculator will give you two key results:

- Final Amount (A): This is the total value of your investment at the end of the given period, including the interest.

- Interest Earned: The difference between the final amount and the principal. This is the total interest accumulated over the years.

For example, if you invest PHP 10,000 at an interest rate of 5%, compounded monthly for 3 years, you’ll end up with a final amount of PHP 11,614.72, and you will have earned PHP 1,614.72 in interest.

Benefits of Using a Compound Interest Calculator

- Quick and Accurate Results: The calculator provides instant and precise results, saving you time and effort in manually calculating compound interest.

- Easy-to-Understand: With clear inputs and results, the tool is designed to be user-friendly for individuals of all financial knowledge levels.

- Helps Plan Investments: By adjusting the variables (principal, interest rate, time, and compounding frequency), you can experiment with different scenarios to understand how small changes impact your investment’s growth.

Why You Should Use a Compound Interest Calculator for Your Financial Goals

Investing your money wisely is the first step to building long-term wealth. The Compound Interest Calculator simplifies this process and helps you visualize how your money can grow over time. It’s an essential tool for:

- Retirement planning: Estimate how your retirement savings will grow.

- Savings goals: Understand how your savings plan will pan out in the future.

- Investing in stocks, bonds, or other assets: Evaluate the potential returns of your investments.

- Education planning: If you’re saving for your children’s education, compound interest can give you a realistic expectation of how much your savings will be worth.

Conclusion

The Compound Interest Calculator is an indispensable tool for anyone looking to make informed financial decisions. It helps you understand the power of compounding, estimate the future value of your investments, and plan accordingly for long-term financial success. By understanding how compound interest works and using the calculator, you can make smarter, more effective choices with your money.

Read: Investment Calculator for Filipinos