Upon realizing that you want to pay or settle your credit card bills, you won’t have a guide attached to the card when you receive it. Although this is most often overlooked, many first-time credit cardholders are clueless as to how they can settle and pay for their credit card bills.

Don’t worry because in this article, we will guide you on how you can pay for your credit card bills.

Most banks offer vast options on how you can settle your bills; they have different credit card bill payment methods for the convenience of customers. Especially if you have online banking, paying your credit card is actually as easy as 1-2-3.

Read: No Annual Fee Credit Cards in the Philippines

We will be categorizing the payment methods into two (2) ways: traditional payments and advanced electronic payments (e-payments); and we will be discussing each of them in-depth, with all details you need to know.

Bank over-the-counter payments

If we were to talk legitimate traditional modes of payment, over-the-counter to banks would be topping the list. In this mode of payment, you would have to travel to any branch of the issuing bank where you got your credit card from.

Payment modes:

The following are the payment modes accepted in over-the-counter bank payments:

- Cash payments

- Check payments

- Direct debit from a bank account

How do you pay your credit card bills using this method?

- Proceed to any branch of the issuing bank you got your card from; it can also be a partner bank.

- Tell a person there that you plan on paying for your credit card—he or she will instruct you to get your queue number.

- You will then be asked to fill out a payment slip.

- When your number is called, hand the number and the payment slip to the teller with the payment you plan to make.

- Should you plan to pay it with a check, ensure that you:

- Make it payable to your issuing bank;

- Write your name, credit card account number (or customer number found on your billing statement); and

- Your contact number on the back of the check.

Read: Low-Income Credit Cards for People Who Earn Php20, 000 or Less in a Month

Payment posting

Paying your credit card bills over-the-counter at a bank would take about 24 hours for the payment to be posted. However, there’s a same-day posting scheme that the banks call but expect it to be posted the next day.

Bills payment over-the-counter

If you live near an SM or any bills payment or bayad centers, this might be the best option for you. There isn’t a lot of people, as compared to banks, if you know the timing.

Unlike banking over-the-counter payments, over-the-counter payments in bills payment centers only accept cash.

Payment modes:

- Cash only

How do you pay your credit card bills using this method?

Paying it via a bayad center or a bills payment center is simple; you just have to present your billing statement and the payment you plan to make.

Don’t have the credit card statement? No problem, you will be asked to fill out a transaction form which you can use as a replacement for the statement.

Once done, wait for the cashier or the person in charge to give you a receipt; this is proof that you were able to pay your credit card bills accordingly.

Read: Pros and Cons of having Credit Cards

Bills Payment centers with credit card payments they accept:

- Cebuana Lhuillier: Bank of the Philippine Islands (BPI) and Metrobank

- Bayad Center: BPI, Equicom, Metrobank, Rizal Commercial and Banking Corporation (RCBC), and UnionBank

- ECPay Partner Outlets: Asia United Bank AUB, BPI, Metrobank, and Robinsons Bank

- TrueMoney: AUB, BPI, and Metrobank

- Robinsons Business Center: BPI, Citibank, Equicom, Metrobank, and RCBC

- SM Bills Payment Counters: AUB, Banco De Oro (BDO), BPI, Citibank, EastWest Bank, Hong Kong and Shanghai Banking Corporation (HSBC), Metrobank, Philippine Natinoal Bank (PNB), RCBC, Security Bank, UnionBank, etc.

Payment posting

Usually, transactions and payments done in bayad centers or in Bills Payment Centers get posted within one (1) to three (3) banking days.

Phone banking

Probably one of the most-unused and uncommon types of payments for credit card is the traditional phone banking. This is especially useful if you’re not able to go to an Automated Teller Machine (ATM) of a bank to do the payment.

Read: When and Why Should You Get a Credit Card?

Payment modes:

- Direct debit from the bank account of the cardholder

How do you pay your credit card bills using this method?

The first thing you have to do is to enroll your account to your bank’s phone banking feature or facility. Just by then you’ll be able to access your bank account to pay your credit card bills via phone banking.

Usually, this method just involves a touch-tone phone to contact the bank. You just have to follow instructions that the prompt says for you to be able to pay your bill.

Do all banks accept credit card payments through phone banking?

Unfortunately, no. There are certain banks that allow this while there are that don’t. Here are the banks that allow phone banking as a means for credit card holders to pay their credit card bills.

Read: Secured Credit Card and What You Need to Know

- Banco De Oro (BDO): 8631-8000

- Metrobank: 5-8000 or 1800-1-888-5800

- Bank of the Philippine Islands (BPI): 889-10000

- Security Bank: 8887-9188

Payment posting

Payments via phone banking get posted on the next banking day from the date of the transaction.

Auto-Debit Arrangement

ADA or more known as automatic payments, are the payments you don’t need to stress about every due date. You can enroll your credit card to have auto-debit arrangement every due date so that it gets debited from your account automatically without you having to do anything.

How can you pay using auto-debit arrangement?

As we’ve mentioned, it’s auto-debit arrangement because the payment gets debited from the cardholder’s account automatically.

Read: Credit Card Application Tips And Techniques For Higher Chances Of Approval

The only downside of this is that if you choose to pay it via ADA, the bank will take it at least two (2) days before the due date of the payment.

Advanced electronic payments

Now that we’re done discussing traditional payments, let us now proceed to the more advanced way of paying your credit card bills. These electronic credit card payments.

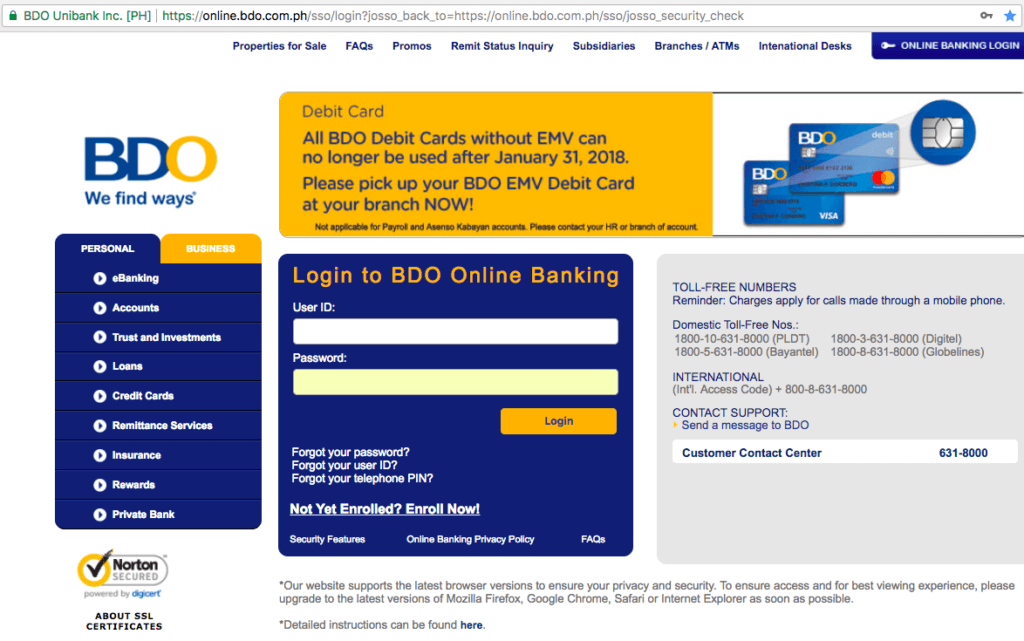

Online banking

If you have a smartphone, chances are, you’re aware that your bank has an online banking facility that would allow you to make transactions 24/7. With online banking, you can pay your credit card bills, too.

Payment mode

- Direct debit from the account of the cardholder

How do you pay your credit card bills using this method?

The first thing you have to ensure is that you have a deposit account (savings or checking) account before you can use online banking to pay for your bill. If you have one, here’s how you can pay:

Read: Other Beep Card Uses You can Take Advantage

- Enroll online banking with your credit card;

- Enroll your credit card as a payable company so that you can send funds to it;

- Once you enroll your credit card successfully, click on Bills Payment

- Choose the correct bank account (deposit) where the payment will be coming from;

- Select the credit card you enrolled as a biller;

- Enter the account number (card number in some instances) and the amount you want to pay;

- Hit on Submit or Confirm to lock in the payment.

Payment posting

Once the payment has been made, it’ll be posted within the next banking day.

ATMs

Many credit cardholders may not know this but they can actually pay their credit card bills via an ATM. You can pay your ATM at your credit card provider, partner banks, or a Megalink or BancNet member bank.

Read: 10 Safety Tips In Using ATMs

Payment mode:

- Direct debit from the bank account of the cardholder

How do you pay your credit card bills using this method?

Just like how you would normally withdraw, here’s how you can pay via an ATM:

- Insert your debit or ATM card to the machine.

- Key in the PIN of your account

- Select Bills Payment > Credit Cards.

- Choose the issuing bank of your credit card

- Enter the account number (card number)

- Select where you want the funds to come from (Current Account) or (Savings Account)

- Key in the amount you want to pay and Confirm

Payment posting

Payments via an ATM are usually posted within the same day (if done earlier than 10 A.M.) or the next banking day.

Mobile Wallet

With the dominance of the mobile wallet industry, many people bank on them for payments. Mobile wallets are convenient because if you have an internet connection, you can easily access them.

Read: How to Pay Utility Bills Online In The Philippines

You can pay your credit cards using two (2) mobile wallets:

- GCash

- Coins.PH

Whatever your mobile wallet is, you can definitely pay your credit card bills there.

Payment method

- Direct debit from the account of the credit cardholder.

How do I pay my credit card bills using this method?

Using mobile wallets are of utmost convenience because it can be done at any time of the day, you don’t have to be physically somewhere to do it, and it’s one of the fastest payment methods in the country.

GCash

The following are the banks that allow credit card payments through GCash:

- Banco De Oro (BDO)

- CitiBank

- RCBC Bankard, Visa, JCB, and MasterCard

- Metrobank

Procedure:

- Register your GCash account if you don’t have one yet;

- Once you register, log-in to it and make sure that you’re verified;

- Cash-in funds to your GCash wallet through any of the following:

- 7-Eleven Stores

- SM Business Centers

- Bayad Centers

- Globe Stores

- Puregold Customer Service Centers

- Open the app and you’ll see that you have the funds;

- Select the Pay Bills option and it’ll show you different icons;

- Click on Credit Cards and select your credit card biller;

- Enter the amount you want to settle;

- Confirm your payment

Read: Applying For A Loan? How To Compute For The Interest Rate From Different Banks?

NOTE: Ensure that you keep a screenshot of the transaction saying that it was successful for safekeeping purposes.

Coins.PH

In using Coins.ph to pay your credit card bills, the following banks are partners with coins.ph for payments:

- Maybank

- AUB

- UnionBank MasterCard and Visa

- BPI

- BDO

- HSBC

- Citibank

- EastWest Bank

- Equicom

- Metrobank

- PNB

- PSBank

- RCBC Bankard

- Security Bank Diners Club and Mastercard

- Standard Chartered Visa and Mastercard

Procedure

- Register to a Coins.ph account if you don’t have one yet;

- Once you register, log-in to it and make sure that you’re verified;

- Cash-in funds to your coins.ph wallet through any of the following:

- 7-Eleven Stores

- GCash

- Cebuana Lhuilier

- Open the app and you’ll see that you have the funds;

- Select the Pay Bills option and it’ll show you different icons;

- Click on Credit Cards and select your credit card biller;

- Enter the amount you want to settle;

- Slide to pay for your bill.

Payment posting

Payments are usually posted within one (1) to three (3) banking days. If you are going to pay via this method, make sure that you do it before the due date of your bill to avoid penalties.

Mobile banking

Almost just the same as online banking, mobile banking is pretty much fast, convenient and can be done at any hour of the day. Mobile banking and online banking are the same. the only difference is the tool used.

Read: How Can I Change BDO ATM PIN?

How can you pay your credit card bills via mobile banking?

- Download the mobile banking app of your bank;

- Log-in and click on other services;

- Enroll your credit card first and once enrolled;

- Enter the amount you want to pay;

- Confirm the payment.

Payment posting:

Similar to online banking, paying via mobile banking would take about the next business day for the payment to get posted.

Those are the few, effective, and easy ways on how you can pay your credit card bills. Some of the traditional ways are still done by many people because they get to interact with “real people.” That’s why they’re hesitant to do electronic payments. However, electronic payments are what the trend is now; it’s designed to make our lives easier.

Now before you read this article, I’m pretty certain that you’re clueless on how you can pay your credit card bills. We do hope that we were able to provide essential and useful information for you.