Not so much different from employed Social Security System (SSS) members, voluntary members also need to pay for their contributions. To start, voluntary members are people who are working abroad (OFWs), self-employed, or non-working spouses. These people, even though they’re not employed, can still pay for contributions to the SSS for the benefits.

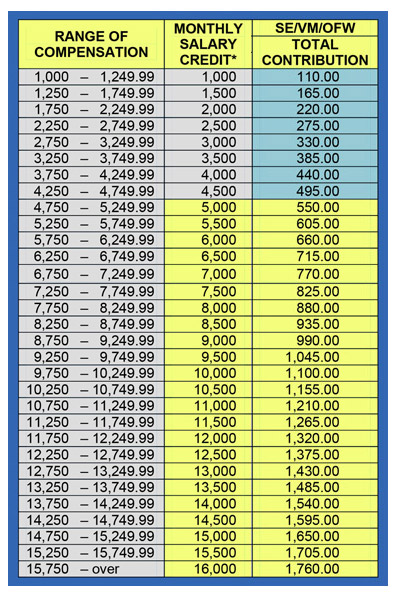

Although it’s much clearer and easier if you are employed here in the Philippines, it’s not really that difficult understanding how much contributions of voluntary members would be. The SSS has a table of monthly contributions for employed and voluntary members. In this way, people would be able to know how much they need to put in their monthly contributions so that they can avail of the benefits of the organization.

Read: How Much Is The Contributions Of Employees To The SSS

How much should be their monthly contributions?

Similar to the employees, voluntary members have a different table when it comes to their contributions. For employees, they pay 11% of their total monthly income to the SSS; so currently, the SSS contribution rate is 11% of the monthly salary credit not exceeding P16,000. This amount is being shared by the employer (7.37%) and the employee (3.63%). Meaning, the employee pays less than half of the requirement from the 11%.

Voluntary members however, are required to satisfy 11% of their total monthly income at the time of their registration. Since they’re voluntary members, they get to decide how much they want to pay. The thing is, it would still depend on the benefits they’re looking at.

Read: List of SSS Benefits Available For its Members

So for example, if the voluntary member is looking at the retirement benefit, the factors would include:

- The total number of your monthly contributions;

- Number of your credited years of membership;

- Average of your monthly salary credits for the last 5 years;

- Lastly, the average of your monthly salary credits throughout all years of your membership

How can a voluntary member pay for their total monthly contributions?

Right now, the SSS has a lot of accredited business centers. One of which would be the famous SM Business Center. In addition to that, you can also visit:

- SSS Main Office – Cashier

- SSS-accredited Commercial Banks

- SSS Branch Tellering Counters

- CIS Bayad Centers

For members abroad, you can pay through:

- I-Remit

- PNB Overseas Payment System

- Ventaja

What is the process of paying SSS contributions as a voluntary member?

Firstly, you need to secure a copy of the RS-5 or the contribution payment return. You need to ensure that it is duly accomplished and that you tick the “voluntary” check box. Submitting a form different from the previous form given to the SSS (either by your company or employer) would change your status to what you will be submitting.

You can get the form from any SSS branch. Otherwise, you can download the form of SSS-RS-5-Form-Contributions-Payment-Return by clicking that link.

When should a voluntary member pay?

Contributions can be paid either monthly or quarterly. If you’re employed, you need to ask your Human Resources Management to ensure when your contributions are submitted. However if you’re voluntary, you can pay it either. The SSS has a prescribed payment method that would depend on the 10th digit of your SSS number:

- 1 or 2 – 10th day of the month

- 3 or 4 – 15th day of the month

- 5 or 6 – 20th day of the month

- 7 or 8 – 25th day of the month

- 9 or 0 – last day of the month

To give you an example, if the 10th digit of your SSS number is 4 and you need to pay for your June contributions, the deadline of contribution payment would be the 15th of July.

How much would the required SSS contributions for voluntary members be?

To give you reference, we have the updated 2018 contributions table for the SSS which you can find here. This post both includes contributions of employees and voluntary members.

But to make things easier, I will be pasting the image below.

Now that you know how much is needed for voluntary members, you can now start and apply these. Not only the amount, you also know when the payments are due. With this, you now have the knowledge whether your payments should be done or if you still have time. In addition, you also have the knowledge how much the requirements are.

Do you have a friend or family that is either self-employed or is an OFW? Share this so they know