A lot of employees yearn to apply for a loan if and when they are struck by a calamity which can be floods, typhoons, and even earthquakes. The Social Security System offers this type of loan to its members which can be beneficial. In this article, we will be guiding you with the requirements and the procedures in order for you to pursue and successfully be approved for this loan.

One thing to keep in mind is that this type of loan is special; meaning, not all members are eligible for this loan and it is not available at any given time, anywhere.

What is SSS Calamity Loan?

The SSS Calamity Loan is a special loan program offered by the SSS to provide financial assistance to members who are affected by natural disasters or calamities. This loan aims to help individuals recover from the economic impact of events such as typhoons, earthquakes, floods, and other similar calamities, especially in areas declared under a state of calamity by the government.

Eligibility Requirements of SSS Calamity Loan

To qualify for the SSS Calamity Loan, the member must meet the following requirements:

- Active SSS Member: The applicant must be an active SSS member at the time of application.

- 36 Monthly Contributions: The member must have at least 36 monthly contributions, with 6 posted within the last 12 months preceding the month of the loan application.

- Residence in Calamity Area: The member must reside in an area that has been officially declared under a state of calamity by the Philippine government or authorities. This declaration is necessary for the loan program to be activated.

- No Existing Loan Delinquencies: Members who have outstanding loans under the Loan Restructuring Program (LRP) or Calamity Loan Assistance Program (CLAP) are not eligible to apply unless they have settled those loans

Document Requirements of SSS Calamity Loan

Here are the document requirements for the SSS Calamity Loan application:

- SSS ID Number or Unified Multi-Purpose ID (UMID).

- Valid government-issued ID (e.g., passport, driver’s license).

- Proof of residency in a calamity-declared area (utility bill, barangay certification, etc.)—if required.

- Disbursement account details (bank account, UMID card, or e-wallet like GCash or PayMaya).

Ensure your information is up-to-date in the My.SSS portal for a smooth application process.

Loanable Amount of SSS Calamity Loan

The amount you can borrow under the calamity loan program is based on your Average Monthly Salary Credit (AMSC), which is calculated from your monthly SSS contributions. Here are the key points:

- The loanable amount is equivalent to one month’s worth of your AMSC, up to a maximum of PHP 20,000.

- If your AMSC is lower, the loan amount will be based on your AMSC rather than a fixed figure. For example, if your AMSC is PHP 12,000, that’s the amount you can borrow.

- This loan is designed to offer immediate financial relief, so it does not require extensive collateral or complex approvals.

Interest Rates and Terms

- The SSS Calamity Loan carries an interest rate of 10% per annum. However, the interest is computed on a diminishing principal balance, which means as you pay off the loan, the interest charged decreases.

- There are no advanced interest payments required, which makes it accessible to members in urgent need.

- Loan Penalties: A penalty of 1% per month will be charged for any delayed payments. If the member defaults, this penalty accumulates over time

How do I apply for this type of loan?

Applying for the SSS Calamity Loan is a straightforward process, particularly if you use the SSS’s online platform:

Step 1. My.SSS Portal

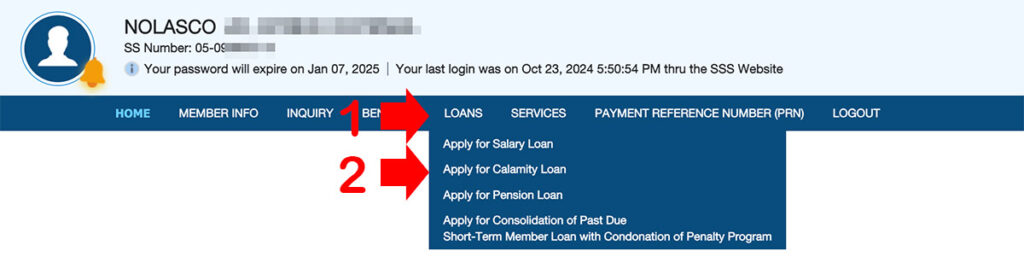

Members are encouraged to apply online by logging into their My.SSS account at sss.gov.ph. Once logged in, follow these steps:

- Go to the Loans tab and click Apply for Calamity Loan.

- Complete the online application form, which will require your personal details, your requested loan amount, and other pertinent information.

- Review and confirm the information before submitting your application.

Step 2. Notification

Once submitted, you will receive a notification of your loan application’s status through email or SMS.

Step 3. Disbursement

If your loan is approved, the amount will be credited directly to your registered SSS UMID card, bank account, or e-wallet (such as GCash), depending on the method you chose during your application. Ensure that your bank details or e-wallet information are up-to-date to avoid delays in receiving the funds.

Important Reminders

- Ensure that you have no existing unpaid calamity loans before applying for a new one.

- If you are an employed member, inform your employer about your calamity loan so they can assist in the automatic salary deduction for repayments.

- Keep track of your loan status via the My.SSS portal to check your amortization payments and outstanding balances.

Read: SSS loan restructuring eligibility and documentary requirements

Aside from SSS the Pag-IBIG (HDMF) and the Government Service Insurance System (GSIS) also offers its members the ability to apply for a loan of this type of concern. Should you need more amount that what you can have, then you can ask for help with the staff from the SSS as to what things you can perform to get a better amount of loan.

Disasters strike and we are for sure not merry when those types of things happen. Good thing that we have an agency that helps its fellowmen recover from a loss that can be marked forever in their joyous hearts.

SSS Calamity Loan FAQs

How much can I borrow under the SSS Calamity Loan?

The loanable amount is based on your Average Monthly Salary Credit (AMSC), up to a maximum of PHP 20,000.

What is the interest rate for the SSS Calamity Loan?

The interest rate is 10% per annum on a diminishing principal balance. This means the interest is recalculated based on the remaining loan balance after each payment.

How do I apply for an SSS Calamity Loan?

You can apply through the My.SSS Portal by logging into your account at sss.gov.ph, filling out the online application form, and submitting the required information. Loan applications are usually done online for convenience.

How long does it take to receive the loan proceeds?

The approval and disbursement of the loan usually take a few days to two weeks, depending on the volume of applications. Loan proceeds are credited directly to your registered bank account or e-wallet.

How is the loan repaid?

The loan is payable over 24 months. Repayment begins two months after the loan is disbursed, giving members a grace period before their first payment is due.

For employed members, repayments are automatically deducted from their salaries, while voluntary and self-employed members must make their own payments.

Can I apply if I have an existing SSS loan?

Members with outstanding loans under the Loan Restructuring Program (LRP) or Calamity Loan Assistance Program (CLAP) are not eligible to apply for a new calamity loan until the previous loan is fully paid.

Can I apply for another calamity loan after paying off the previous one?

Yes, you can apply for another calamity loan if you meet the eligibility criteria and there’s a new declaration of calamity in your area. However, you must have fully paid your previous calamity loan.

What happens if I move to a different location?

As long as you reside in the calamity-declared area at the time of the loan application, your eligibility for the loan remains valid even if you move to a different location afterward.

Can I cancel my loan application?

Once the loan is approved and the proceeds are disbursed, the loan cannot be canceled. However, if you wish to settle the loan early, you can do so by paying the outstanding balance at any time.

Are there other loan options available besides the calamity loan?

Yes, SSS also offers other loan programs, such as the Salary Loan, Educational Loan, and Housing Loan, depending on your needs.

Disclaimer: The information provided regarding the SSS Calamity Loan is for general informational purposes only and may not reflect the most recent updates or changes in policy. For the most accurate and current details, including eligibility, loan terms, and requirements, please refer to the official Social Security System (SSS) website or contact SSS directly. This content is not intended to be used as a substitute for professional financial advice. Always verify information with official SSS channels.

Read Also:

REFERENCE:

- SSS Calamity Loan (https://www.sss.gov.ph/calamity-loan/)

Montalban Rizal are affected IS IT QUALIFIED

hi mam how can i apply calamity loan im in a

private employer

mam tatanon q lang poh sna kung pwd aq mag loan calamity loan ngayon

mam pra poh mka pag loan aq calamity mam

hi maam how can i apply calamity loan self employed

magandang umaga po pwede po ba mag calamaty loan ang ofw sa sss or pag ibig? maraming samalat po

pano po mag apply ng calamity loan o

nline

Pano po mag apply ng calamity loan online

How to apply and submit through online in calamity loan?

Mam pwd b k mgloan self employed 3 yers n po higit hulog k

Huw to apply online

maam gusto ko rin po mag loan

Pwedi po ba mka avail nang calamity loan kahit may existing salary loan pa..

Pwede n’yo po ito ma check online kung naka register ang SSS account ninyo https://www.efrennolasco.com/how-to-check-sss-loan-eligibility-online/

Not available as the moment Ang Calamity loan,tinanggal muna nila member log in sa SSS Portal para nagbigay daan sa mga employer na nag process ng kanilang sbws. Hintay pa natin update ni SSS.Thanks

Para complete guidelines for the requirements sundan Ito: https://announcement.ph/sss-covid-19-calamity-loan-program-to-be-launched-on-the-24th-of-april/

maaari po bang mag apply online ng sss calamity loan? if Yes, How can i apply for my sss calamity loan?

Sa ngayon ang website ng SSS priority muna yung mga sa Small Business Subsidy

Not available as the moment Ang Calamity loan,tinanggal muna nila member log in sa SSS Portal para nagbigay daan sa mga employer na nag process ng kanilang sbws. Hintay pa natin update ni SSS.Thanks

Para complete guidelines for the requirements sundan Ito: https://announcement.ph/sss-covid-19-calamity-loan-program-to-be-launched-on-the-24th-of-april/

guxto ko rin mag loan

Qualify po bang mag calamity loan kahit hindi updated ang posting ng monthly contributions. As per employer, bayad na daw until December 2019.

Ito po qualification ng SSS:

Members who’ve had at least 36 months of contributions; with six (6) posted within the past 12 months on or before the month of the application.

good day SSS,i just want to know how is it to apply through online for this type of loan and how sure is it to be approved?

Not available as the moment Ang Calamity loan,tinanggal muna nila member log in sa SSS Portal para nagbigay daan sa mga employer na nag process ng kanilang sbws. Hintay pa natin update ni SSS.Thanks

Para complete guidelines for the requirements sundan Ito: https://announcement.ph/sss-covid-19-calamity-loan-program-to-be-launched-on-the-24th-of-april/

How to apply a sss calamity loan

Yung asawa q Po Hindi nakasali SA sbws pero Ang mga katarabaho niya nkakuha..nag palit xa Ng cp number Kaya di Niya Alam Kung Anu talaga Ang totoo may website Po b na macheck Kung Wala xa tlga SA listahan Ng sbws? Sabi Kasi Ng employer Niya Wala xa SA listahan,meron nman siyang tin number

Ma’am pno mag calamity loan s sss

Pwede pa po ba mag pasa ng sss calamity loan form

Pwede na po ba magpasa ng calamity loan form

pwede po

Hi po,pwedi po mag tanong? Naka limutan KO po kasi ang unang fill up ko sa Umid card kng ano po don ang na fill up ko para sa user id ko po,

Hello Joebert iba po yung UMID card Application form hindi po makikita dun ang iyong user id, kung nais mong ma recover ang iyong SSS user ID pwd kang tumungo sa SSS office or kung active naman ang iyong ginamit na email pwd mong gawin online, narito ang gabay: https://www.efrennolasco.com/how-to-recover-sss-online-account-forgot-user-id-password/

Yes, you could. Basta up to date ang payment. Hindi delinquent.