If you’re considering a loan or loan renewal with the Social Security System (SSS) in the Philippines, it’s essential to first check your eligibility. The SSS makes this easy by allowing members to verify eligibility directly through their online portal. By logging into your SSS account, you can view your contributions, repayment history, and outstanding balances to determine if you meet the requirements for a loan or loan renewal. This guide will walk you through each step, ensuring a quick and hassle-free process for checking your SSS loan renewal eligibility online.

How to check SSS Loan eligibility online

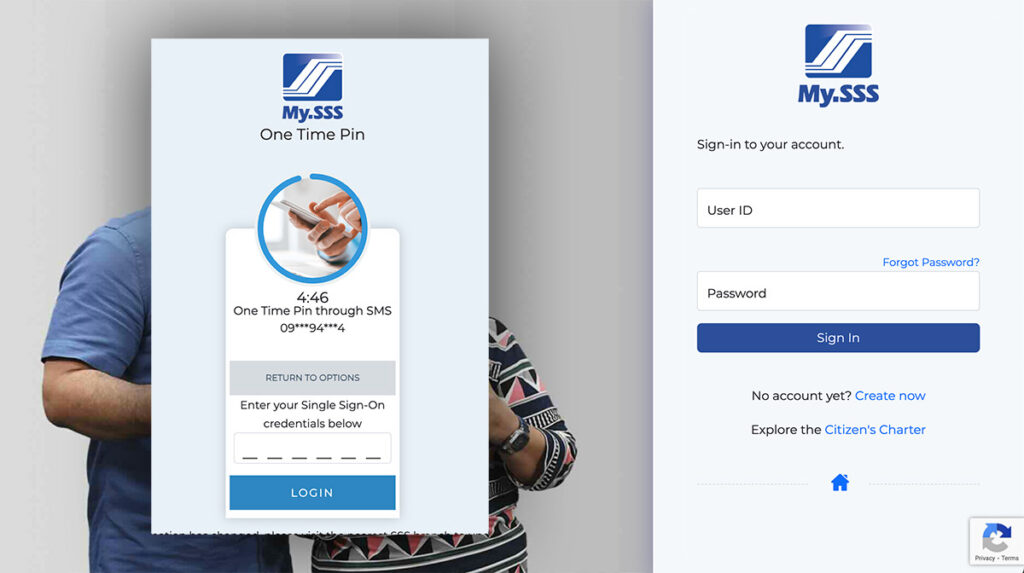

Step 1: Go to the SSS Website at www.sss.gov.ph log in to your account using your User ID and Password under Member Log-in then click Submit. If in any case you forgot your username or password, you can read my other tutorial on How to recover SSS Online Account “Forgot Username and Password”. Get a PIN to proceed to the SSS dashboard.

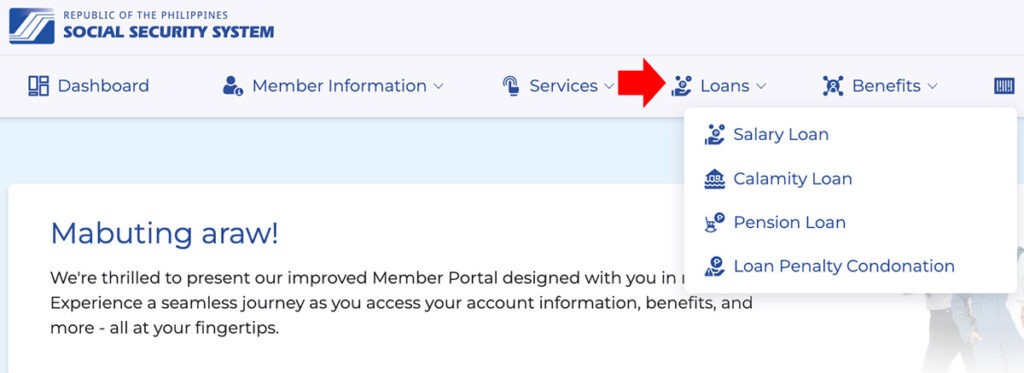

Step 2: Inside the dashboard go to “Loans” menu, then select “Salary Loan” if you want to renew your salary loan. You can also check if you are eligible for calamity loan and pension loan.

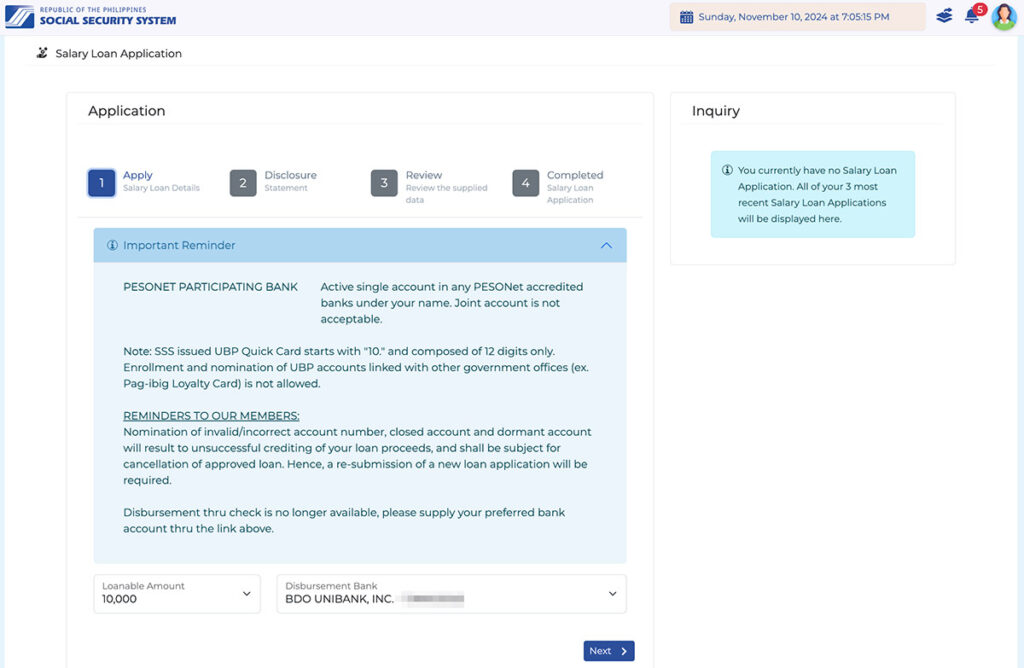

Step 3: If you are eligible for loan renewal, you can see how much the amount you can avail for a loan, you can also proceed to apply online.

NOTE: You will need to add a disbursement account where your funds will be deposited. A bank account under your name.

According to SSS even if you have paid your latest amortization, but it has not been remitted yet by your employer to SSS, or it has not been posted yet to your SSS account, then you cannot renew your loan.

Finally, concerning the proceeds of the renewal loan is any amount greater than or equal to zero as long as the outstanding balance on the previous loan is deducted.

Types of SSS Loan

The SSS in the Philippines offers several loan programs, each tailored to specific financial needs:

1. Salary Loan

Designed for short-term financial assistance, this loan provides up to twice the average monthly salary credit for members who have made at least 36 monthly contributions. Loan terms include a 10% interest rate per year and a repayment period of two years.

Intended for members affected by natural disasters, this loan offers a one-time financial aid with favorable terms. It’s available during declared states of calamity and provides up to the monthly salary credit, with low interest and an extended repayment period to help members recover from disaster-related expenses.

3. Housing Loan

Available for home acquisition, construction, or improvement, the SSS housing loan assists members in building or purchasing a home. Eligible members can borrow based on their monthly contributions and repayment capability. Loan terms include interest rates of around 8-9% with repayment periods of up to 30 years.

4. Pension Loan

Aimed at SSS pensioners, this loan provides financial assistance for medical or living expenses. Pensioners can borrow up to six times their monthly pension amount, with the loan automatically deducted from their monthly pension over a set period.

5. Business Development Loan

For members looking to expand or start a business, this loan provides financing for capital or expansion. It includes a comprehensive application process where members must submit business proposals and financial projections. Loan terms vary based on the amount and purpose, offering flexible interest rates and repayment plans.

These loans each have specific eligibility criteria, application processes, and repayment terms, designed to assist SSS members in various stages and financial situations.

Disclaimer: I am not affiliated with Social Security System (SSS), I am also a member and I make this tutorial from my experience only which I want to share with you to help other members who don’t know the procedure how to check SSS Loan renewal on the SSS Website.

More Helpful tutorials from EfrenNolasco.com

- Everything you need to know about the New Postal ID

- How to Register to BDO Online Banking

- How to Pay Smart Bills Online

- How to Book Online in Cebu Pacific

- How to enroll on PNB Online Banking