The Bureau of Internal Revenue (BIR) has an online system where self-employed individuals can get a Tax Identification Number (TIN) online. The BIR Online Registration and Update System (ORUS) website is where various taxpayer services can be done such as TIN Verification, TIN Isuance, New Registration, Update Information, and others.

What is BIR Online Registration and Update System (ORUS)?

BIR ORUS is an online platform developed by the BIR to streamline and digitize the process of registration and updating taxpayer information. ORUS is aimed at making it more convenient for taxpayers to manage their records without the need to visit BIR offices physically.

Key Features of BIR ORUS

- TIN Application

Users can apply for a new Taxpayer Identification Number (TIN) online through the ORUS platform, simplifying the process for individuals who are required to register with the BIR for tax purposes. - Updating Taxpayer Information

The system allows taxpayers to update their personal information, such as contact details, employment status, or civil status, ensuring that BIR records remain current. - Application for Authority to Print Receipts/Invoices (ATP)

Businesses and self-employed individuals can apply for an Authority to Print (ATP) their official receipts and invoices using the ORUS system. - Submission of Documentary Requirements

Taxpayers can upload and submit required documents, such as identification cards or other supporting documents, directly through the platform without having to go to a BIR office. - Tracking and Monitoring

ORUS allows users to monitor the status of their applications or updates, giving them a real-time view of the process.

Benefits of Using ORUS

- Convenience: Taxpayers can perform various tasks related to their tax records online, reducing the need for physical visits to BIR offices.

- Efficiency: The online platform aims to speed up the registration and updating process, minimizing delays and errors.

- Accessibility: ORUS is available anytime and anywhere, making it easier for taxpayers to manage their tax records.

How to Get BIR TIN Number Online Using ORUS

Here’s a detailed step-by-step guide on how to get a BIR TIN online using the ORUS

Step 1: Access the ORUS Website

Open a web browser and go to the BIR ORUS portal at https://orus.bir.gov.ph. Ensure you have a stable internet connection and that you’re on the official website to avoid phishing attempts.

Step 2: Create an ORUS Account

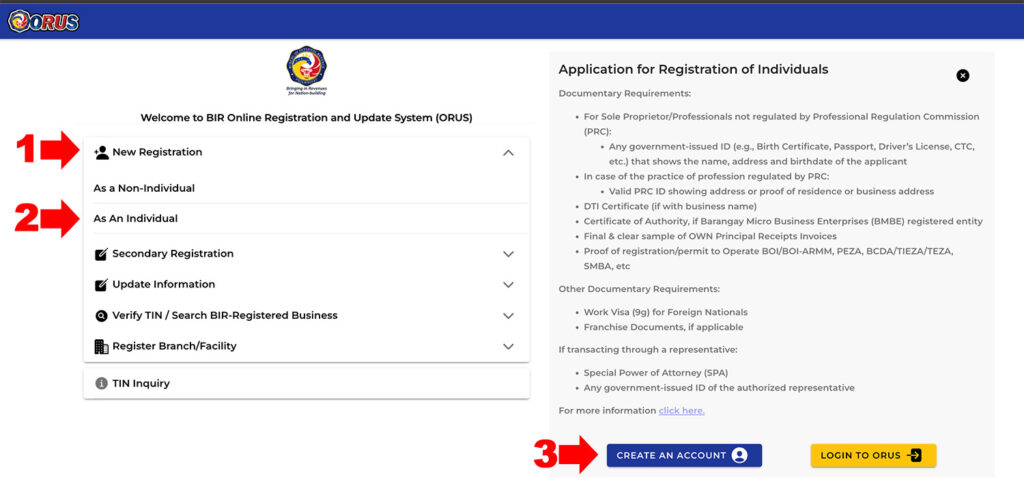

Click “New Registration” then select “As An Individual“. On the right side just below the list of Documentary Requirements, Click the Create an Account button.

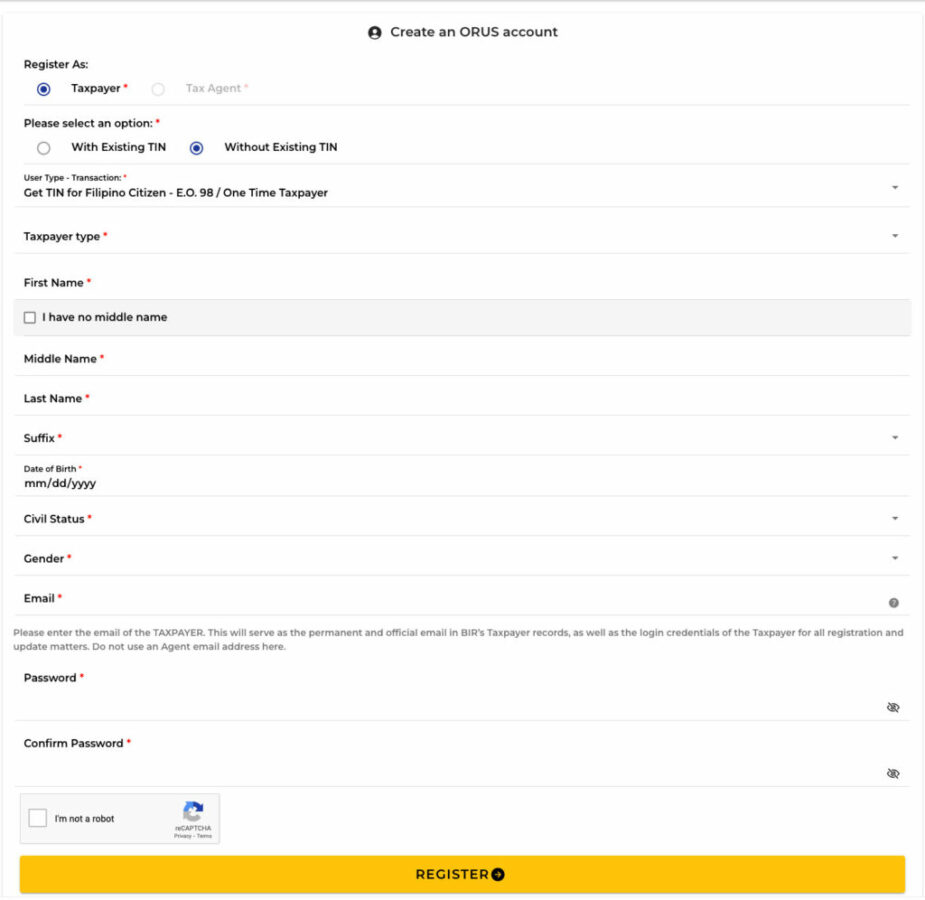

Agree to the Terms and Conditions that pop up, and continue to Provide Personal Details, You will be asked to input your personal information such as:

- Full Name

- Date of Birth

- Email Address

- Mobile Number

Set a Password. Create a secure password that follows the platform’s guidelines (usually at least 8 characters, a mix of letters, numbers, and special characters).

Verify Your Account

After registering, ORUS will send a verification link to your email. Open your email, click on the link to verify your account, and activate your ORUS profile. If you didn’t receive an email, check your Spam folder.

Step 3: Log In to Your ORUS Account

After registering a BIR ORUS account, you can now log in using the Email and Password and Apply for BIR TIN online.

Return to the ORUS Portal: After verifying your email, go back to the ORUS website and log in using your newly created credentials (email and password).

Access the Dashboard: Once logged in, you’ll be taken to your user dashboard, where you can see options for various BIR services.

Step 4: Start the TIN Application

- Click “New Registration” then select “As An Individual“.

- On the right side Click the Fill Up Registration Form 1904 button.

Step 5: Fill Out Personal Information and Employment Details

Complete the Application Form

You’ll need to fill out a detailed form including:

- Full name

- Birth date and birth place

- Nationality

- Address (both residential and mailing address)

- Civil status

- Contact details (email, mobile number)

Employment Information

If you are applying as an employee, you’ll be asked for your employer’s details such as:

- Employer’s TIN

- Company name

- Company address

If you’re self-employed, input details about your business or freelancing activities.

Step 6: Upload Required Documents

To validate your identity, you will need to upload certain documents depending on your application type. Typically, the following documents are needed:

- Government-Issued ID (e.g., passport, driver’s license, or UMID)

- Birth Certificate (if proof of birthdate is required)

- Proof of Employment (for employees, this could be your job contract or certificate of employment)

- Business Registration Documents (if self-employed or a business owner)

Ensure that the documents you upload are clear, readable, and meet the file size requirements set by the platform (usually in PDF or JPEG formats).

Step 7: Submit the Application

- Review the Application

Double-check all the information you’ve entered to ensure accuracy, especially your personal details and uploaded documents. - Submit the Form

Once satisfied with your input, click on the “Submit” button. ORUS will begin processing your application.

Step 8: Wait for Confirmation

- Acknowledgment

After submitting, ORUS will display an acknowledgment that your TIN application has been received. You’ll also receive a confirmation email stating that your application is under review. - Processing Time

Processing can take a few days depending on the volume of applications. You can check the status of your application by logging into your ORUS account and checking your dashboard. - TIN Issuance

Once your application is approved, your TIN will be provided electronically, usually via email or within your ORUS dashboard. You may not need to visit a BIR office, as the TIN is issued digitally.

Step 9: Claim Your TIN ID (Optional)

While you will receive your TIN electronically, you may want to obtain a physical TIN card for identification purposes. Some BIR branches might require you to visit them for the physical issuance of the card. In such cases:

- Visit the BIR Office

You may be instructed to visit the nearest BIR Revenue District Office (RDO) to claim your TIN card. - Bring Valid ID

Make sure to bring a valid ID to claim the physical card.

You can also watch the detailed tutorial in this YouTube video.

Tips:

- One TIN Rule: Remember, you are only allowed one TIN in the Philippines. Applying for multiple TINs is illegal.

- Use a Valid Email: Ensure the email address you use for registration is active and frequently checked, as BIR will send updates regarding your application through this email.

- Monitor your Application: You can log in to ORUS anytime to check the status of your application.

By following these steps, you should be able to successfully apply for and receive your BIR TIN online using the ORUS system.

Read Also

- Renewal of BIR Registration Certificate, Mayor’s Permit, and Barangay Permit

- How to Register Your Business with the Bureau of Internal Revenue (BIR)