The Social Security System (SSS) is the executive body of the Philippine government that gives benefits for private employees of the country. If employed, then the employer, together with its employees would work hand-in-hand to pay the contributions. Self-employed individuals, on the other hand, must present their SSS PRN or Payment Reference Number for them to be able to pay their contributions.

In this article, we will be detailing how you can generate your SSS PRN which you can use to pay contributions. Voluntary members can enjoy the benefit of paying without having to visit the nearest SSS regional office.

Read: Unlocking your Locked SSS Online Account

What is the SSS PRN?

The Payment Reference Number (PRN ) is a unique number that is generated for each member of the SSS—this number is unique so it’s just one (1) PRN for one SSS member.

This is what SSS members need in paying for their SSS contributions—for the system to discern which is which—to avoid multiple stacking of contributions to just one account.

Misconception about SSS PRN

Since this article will be focusing on how you can generate your PRN, we need to understand what the PRN is not. Most people, especially those who regularly pay their contributions online, mistake the PRN to be something else.

To clarify this, let’s discuss the misconception that most people have when it comes to the PRN. Always remember that the PRN is not:

- The Social Security Number (SSS) that most people think it is; and

- The Common Reference Number or CRN that you can immediately find in your Unified Multi-Purpose ID (UMID)

So to end the confusion, the PRN is neither of the things mentioned so be sure to always remember that.

How to get SSS PRN?

There actually are a few ways how you can get your PRN. Once you are able to generate your PRN, you can use it to make your monthly premium contributions to the SSS.

For voluntary and individual members, there are four (4) ways on how you can generate your PRN.

1. Via SMS (Text Message) or Call

Type SSS PRN <10-digit SSS number> and send it to 2600 (Note: Standard text messaging rates apply).

You can call the hotline of the SSS or the PRN hotline. They’re open from Mondays until Fridays 24 hours a day. You can contact 920-6446 to 55 or their toll-free number at 1-800-10-225.

Read: How to Pay Utility Bills Online In The Philippines

2. Via Email

You can shoot an email to the PRN helpline at [email protected] or at [email protected]. Through those services, you can request for your PRN.

What you need to indicate in your email are the following:

- Your full name

- Your SSS number or Common Reference Number (CRN)

- Date of birth (DOB)

3. Get PRN Via My.SSS Website

This is probably the most done part since it doesn’t require any type of effort from SSS members—they just need an online account, an internet connection, and voila!

If you don’t have an online SSS account yet, you can read our guide on how you can create one.

Read: Register SSS Online Account

After you’ve created your account, you just have to go and log-in via the SSS website at sss.gov.ph. After that, be sure to select the Member Login box.

1. Enter the User ID you’ve set as well as the password.

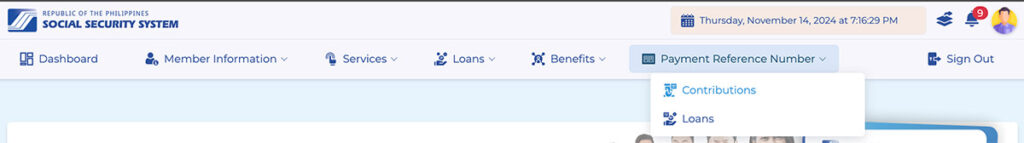

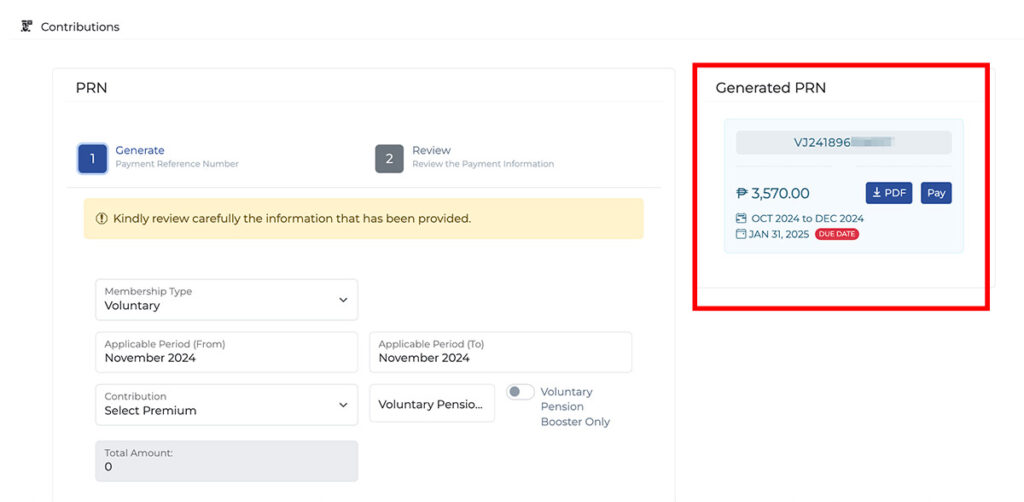

2. Once in your account, you will be revealed different options; one of which is the Payment Reference Number (PRN) and this can be seen in the main navigation menu. Hover your mouse the select Contributions .

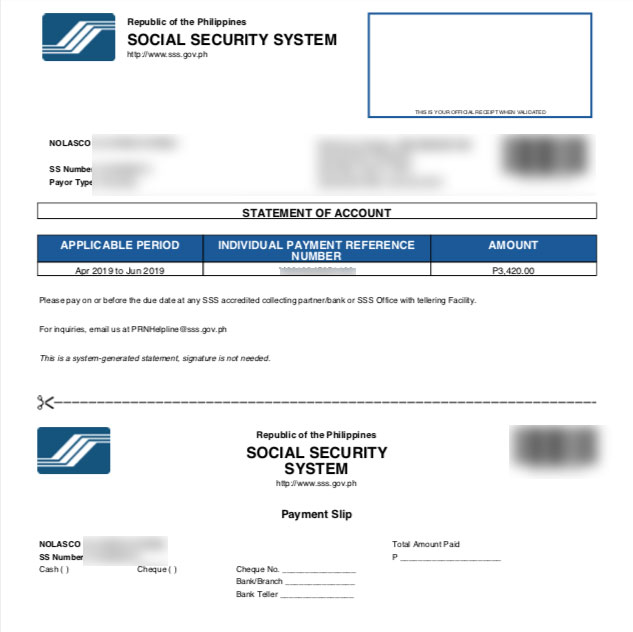

3. When you click it, your Payment Reference Number (PRN) will be displayed on the page, you can download the PDF file if you want to pay to Bayad Centers or banks (over the counter) or you can pay directly using the Pay Button. You can also use GCash or Maya to pay you contribution.

Read: How to Pay SSS Contribution Online using GCash

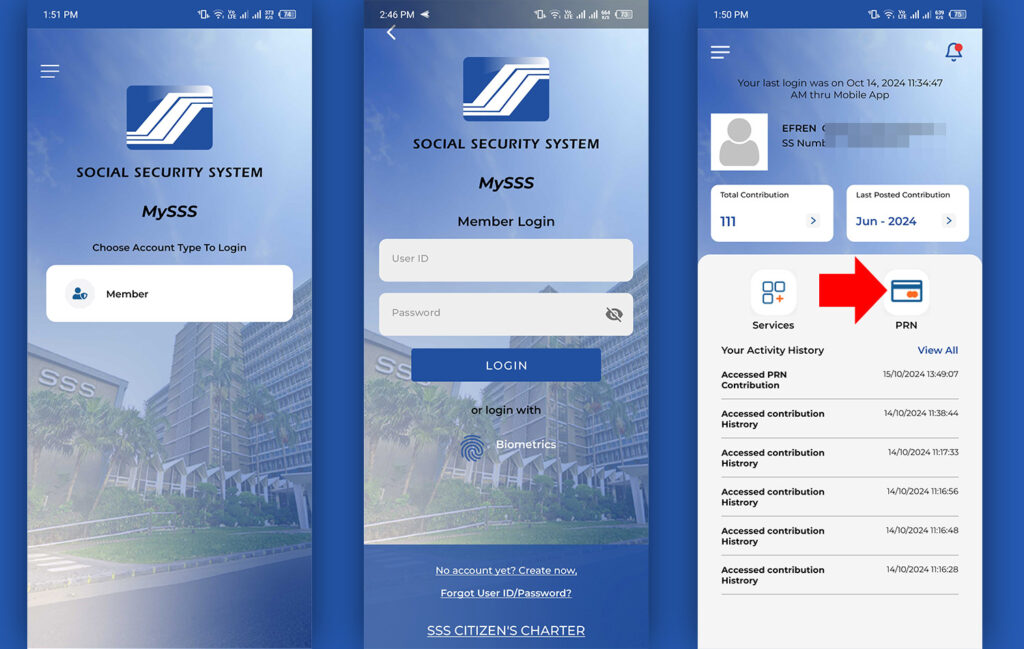

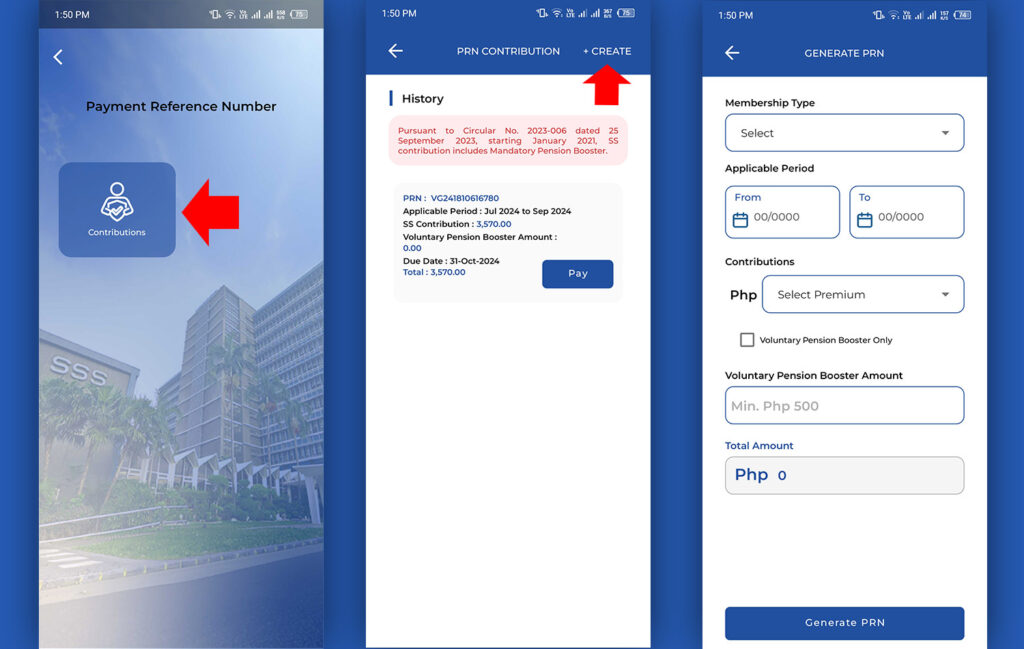

4. Using the SSS mobile application

You can also get SSS PRN using the SSS mobile application, if you don’t have one installed you can easily download it in Play Store, App Store, or App Gallery. Once you installed login using your My.SSS account username and password.

The system will automatically generate PRN for the Payment period but you can still create if you want to advance the payment.

Can’t SSS members just use their CRN or SSS numbers when paying for contributions?

They actually can, in fact, this has been the traditional way of paying for contributions. The only real reason why the PRN was made was because of the fact that paying contributions via the PRN get posted in real-time.

Once you pay your contributions, you will immediately see them reflected on your SSS account.

Read: Where and How to Complain About Unremitted SSS Contributions by Employer

No more delays, no more waiting for the next cycles for your contributions to be posted! It can easily be posted in real-time if you have and know what your Payment Reference Number (PRN) is! Imagine the time you can save by just knowing what it is.

Are you self-employed that you want your monthly contributions to be completely paid by you? Are you currently trying to find ways how you can generate your PRN for faster and more accurate contribution posting? Don’t worry because we got you. By generating your PRN, you can easily abide by your required monthly premium contributions without having the stress of it when being posted.

Read Also:

- How to Pay SSS Contributions online using Maya App

- How to Pay Meralco Bills Online

- Pay Smart Bills Online using BDO Online Banking

- How To Pay SSS Contributions Online Using Coins.Ph