PayPal is the most safe and secure online bank today, it is trusted by most online shopping sites as a payment option of their goods and services. Like eBay they only accept payment from Paypal, maybe because it is very convenient to the buyer and the seller. In this post, you will learn How to Open a PayPal Account in the Philippines and Get Verified

The good thing as a buyer having a PayPal account is that you don’t need to expose your credit or debit card number to buy online, you only need to enter your registered PayPal email address and password and you’re finished. So how can you register to PayPal for free? It’s very simple follow the step below.

What is PayPal

PayPal is a popular online payment platform that allows individuals and businesses to send and receive money securely over the internet. It was founded in 1998 and has become a widely accepted digital payment option, particularly for online shopping, freelancing, and e-commerce transactions.

Key Features of PayPal

Send and Receive Money: PayPal enables users to transfer money to anyone with an email address, anywhere in the world. All you need is the recipient’s email address or mobile number to send funds.

Online Shopping and Payments: PayPal is accepted by millions of online merchants and e-commerce platforms globally, making it a convenient payment method for online shopping, booking services, or purchasing digital goods.

Linking Bank Accounts and Cards: Users can link their bank accounts, credit, or debit cards to PayPal to fund transactions or withdraw funds. In the Philippines, you can link local banks or use a GCash or PayMaya virtual card.

Currency Conversion: PayPal supports multiple currencies, allowing users to make cross-border payments with automatic currency conversion. However, fees may apply to convert from one currency to another.

Invoicing and Business Tools: For businesses and freelancers, PayPal offers tools to create invoices, manage transactions, and accept payments on websites or online stores.

Mobile App and Integration: The PayPal mobile app lets you send and receive money on the go, and it can be integrated with various e-commerce platforms, making it a versatile choice for online entrepreneurs.

Type of Debit/Credit Card supported by Paypal

- Visa

- Mastercard

- Discover

- American Express

How to Open PayPal Account in the Philippines

Opening a PayPal account in the Philippines is straightforward and can be completed in a few steps. Here’s a step-by-step guide:

Step 1: Go to the PayPal Website

Visit PayPal’s official website and click on Sign Up at the top right corner.

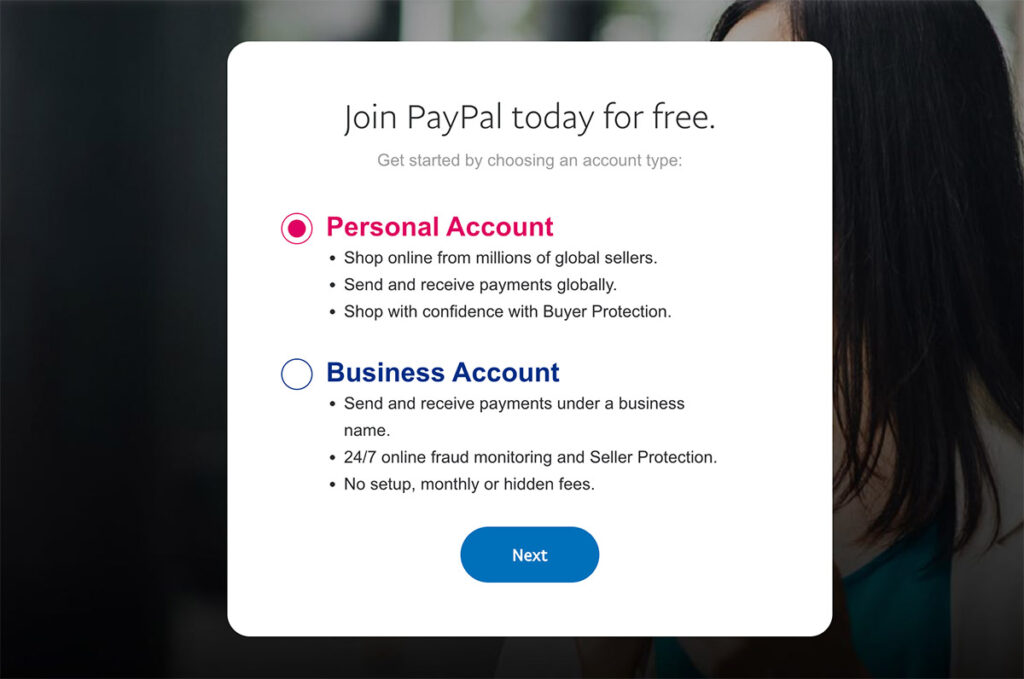

Step 2: Choose the Account Type

Select the account type that best suits your needs:

- Personal Account: For online shopping and receiving payments as an individual.

- Business Account: For sellers or businesses needing to invoice clients or accept payments online.

For most individuals, a Personal Account is suitable, so choose this option and click Next.

Step 3: Fill in Your Information

Enter your email address, Phone number and create a strong password. Choose a password that you haven’t used on other sites for added security.

Provide the following details:

- Full Name (Make sure it matches the name on your bank account for smoother transactions)

- Address

Click on Continue after filling out the form.

Step 4: Link a Bank Account or Credit/Debit Card

To fully use your PayPal account, you’ll need to link it to a funding source:

- Link a Bank Account: Enter the bank details of a local bank in the Philippines. Most major banks are compatible with PayPal.

- Link a Credit/Debit Card: Use a card that supports international online transactions (Visa, Mastercard, or American Express cards generally work well).

Note: You can also link GCash or Maya virtual cards if you don’t have a credit card.

Step 5: Verify Your Email

PayPal will send a verification email to the address you provided. Open the email and click on the link to confirm your account.

Step 6: Set Up Additional Security

Go to your Account Settings and enable Two-Factor Authentication (2FA) for added security.

Step 7: Verify Your Account (Optional but Recommended)

For higher limits and a more secure account, consider verifying your PayPal account:

- Go to Wallet and select Link Bank Account or Link Credit Card.

- Complete the verification process following PayPal’s prompts.

Using PayPal in the Philippines

With your PayPal account set up, you can start using it to send or receive payments. If you’re a freelancer or online seller, you can also integrate PayPal with platforms like Lazada, Shopee, or GCash to transfer funds more conveniently.

Additional Tips

- Fees: Be aware of conversion fees and withdrawal fees. PayPal charges a 4.4% transaction fee plus a fixed fee for currency conversion.

- Withdrawals: To withdraw funds to your Philippine bank account, PayPal typically charges a PHP 50 fee if the withdrawal amount is less than PHP 7,000.

Setting up your PayPal account in the Philippines is quite simple, and once you complete these steps, you can use it for online transactions locally and internationally!

Frequently Ask Questions (FAQs)

Here are some common questions people have about using PayPal, particularly for users in the Philippines:

General Questions

Is PayPal free to use?

Yes, creating a PayPal account is free, and there are no fees for sending money within the same currency or using it for online purchases. However, fees may apply for currency conversions, receiving payments, or withdrawing funds to a bank account.

What types of accounts can I open on PayPal?

PayPal offers Personal accounts for individual users and Business accounts for companies or freelancers who need to receive payments regularly and use invoicing.

Can I link a local bank account or card to my PayPal account?

Yes, you can link most Philippine bank accounts and Visa or Mastercard debit and credit cards. You can also link virtual cards like GCash and Maya.

What currencies can I use with PayPal?

PayPal supports multiple currencies, allowing users to send and receive payments internationally. However, conversion fees apply for currency exchanges.

For Sending and Receiving Money

How long does it take to receive funds on PayPal?

Payments within PayPal accounts are usually instant. However, if the sender uses an eCheck, it may take 3–5 days to clear.

Are there fees for receiving money?

Yes, PayPal charges a fee of 4.4% plus a fixed fee per transaction when receiving payments from abroad. The fee for local transactions within the Philippines may vary based on the payment method.

How do I withdraw money from my PayPal account to my bank?

To withdraw funds, go to Wallet, select your bank, and enter the amount. Withdrawals to Philippine banks may take 2–4 business days, with a fee of PHP 50 if the withdrawal is less than PHP 7,000.

Can I receive money from other countries using PayPal?

Yes, you can receive international payments. PayPal supports cross-border transactions, but currency conversion fees may apply if funds are sent in a different currency.

For Security and Verification

Is PayPal safe?

Yes, PayPal uses encryption and fraud prevention tools to keep accounts secure. Enabling two-factor authentication (2FA) adds another layer of protection.

Do I need to verify my PayPal account?

Verification is recommended but not mandatory. It’s required if you want to lift receiving and withdrawal limits. To verify, link and confirm your bank account or card.

What is PayPal Buyer Protection?

PayPal Buyer Protection covers eligible purchases if you don’t receive the item, or if it’s significantly different from the description. It applies mainly to goods purchased online.

Troubleshooting and Account Issues

Why is my PayPal payment on hold?

PayPal may hold payments for security reasons, especially for new accounts or large transactions. Funds are typically released within 21 days or sooner if you confirm delivery.

What should I do if my account is limited?

If your account is limited, PayPal may ask you to provide additional information or documents to resolve the issue. Follow the instructions in the Resolution Center.

Why was my card or bank rejected?

Some banks or card issuers may restrict transactions with PayPal. Contact your bank to check if your card supports online and international payments.

How can I close my PayPal account?

Go to Settings > Account Options, and select Close Account. Make sure to withdraw any remaining balance before closing.