In the previous years, the government solved problems of land titling and land transactions through the establishment of the Torrens System. This served and will continuously serve as protection for land owners and buyers who transact land transactions.

However, processing land transfer is still tedious enough for a non-expert. It may take some time to finish everything and could also be too costly to hire someone who can assist you with this process. So in order for you to have an idea on what to do, here are some helpful tips on this process.

Read: How to verify if the land title is authentic

Step 1. The first thing to do is to provide the documentary requirements set by the Assessor’s Office, Register of Deeds and Treasurer’s Office in your area. Depending upon the agreement of the buyer and seller, but the seller usually file for the tax clearance required by the Treasurer’s Office. To be cleared, it is important to submit receipts and tax declarations of the land to said office. If there are arrears, then it is need to pay them for the transfer to take place.

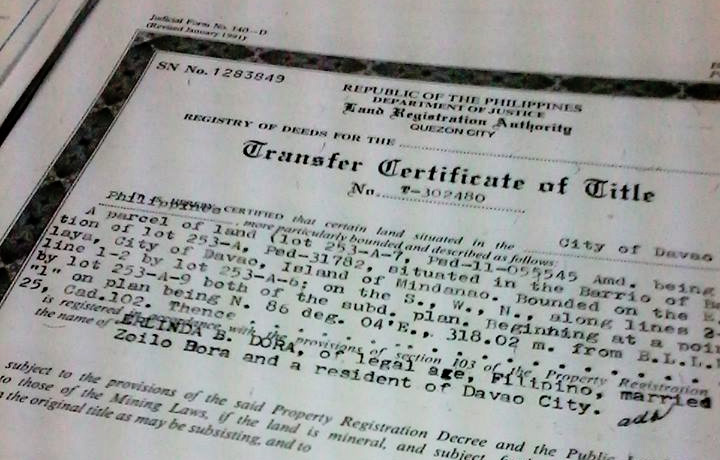

Step 2. Secure assessment of Transfer of Taxes from BIR and City Treasurer’s Office and file for Issuance of Certificate Authorizing Registration (CAR) or BIR clearance from the BIR. The CAR will serve as evidence that the sale has taken place and the taxes has been paid. BIR will ask for documents such as TIN of seller and buyer, Notarized Deed of Sale, certified true copy of the Tax Declaration by the Assessor’s Office, and a copy of the Original Certificate of Title (OCT) or Transfer Certificate of Title (TCT).

Step 3. Pay the transfer taxes within 60 days from the date of execution of the Deed of Sale to the Treasurer’s Office presenting the CAR from the BIR, Tax Clearance from the Treasurer’s Office, and official receipt of payment of documentary tax from the BIR.

Step 4. File documents at the Registry of Deeds for the issuance of title. The documents to be presented are the copy of deed of absolute sale, receipt of payment of transfer tax, CAR, tax clearance, and TCT in the name of the seller.

Step 5. File documents at the Assessor’s Office for the issuance of new Tax Declaration.

Read Also: Documentary requirements for land transfer in the Philippines

On a case to case basis, processing to acquire Torrens Certificate of Title for land transfer is not easy as expected. There are problems along the way if you have not checked thoroughly on the previous ownership of the land. So to be sure, check first the encumbrance or marks at the back of the title on the property you are going to purchase.

If there are a lot of marks, ask someone who is knowledgeable enough on this matter and ask opinion whether to proceed with the purchase or not. If not, buy a title that is free of encumbrances. Aside from this, transferring title of land that are undivided or has many owners is complicated because all the owners need to sign for the approval of the sale. So it is advisable to buy a land that has already been subdivided from previous owners to avoid complication.

You may also want to read this:

- How to reconstitute or replace lost/destroyed Land Titles

- Check Pag-Ibig Fund Acquired assets Online

- Main Benefits of Pag-Ibig Membership

I purchased a condo unit thru bank payment for 5 years. I finished the payment 2 years ago. The bank issued certificate of full payment and the original copy of title.

The staff of the bank told me to process the “cancellation of anotation” in the city hall. Could pls enlighten me what is this cancellation of anotation?

How to transfer the land I bought 20 yrs ago but the document is only a certificate of rights to ownership??

I brought property from a housing development, developer is not cooperating on transfer of title since i fully pair the said property. Upon checking on assessors office they are not updated on Tax for lot, and not paying tax on building. What i can do? Thank YOU in advance.

It means to cancel the previous owner (mother title) in favor for u

I Ask the landtitle of my grandfather is the same name.

What if it’s donated by a family member the title?

It is valid for buying a land and the only documents from the seller is declaration only?