The Philippine Health Insurance Corporation or PhilHealth is a government-owned and controlled corporation that deals with health care financing for Filipinos. PhilHealth helps members and qualified beneficiaries and dependants with medical and hospitalization expenses.

If you want to take advantage of the benefits given by PhilHealth to its members, you can apply or register online, you don’t need to appear physically in the PhilHealth office to file an application.

This online application is available for the following individuals;

- Employed Members

- Self-employed

- Overseas Filipino Worker (OFW)

- Retirees in the Government and Private Sector

When you qualify for PhilHealth Online registration, proceed by following the instructions below. Please note that the steps given are only Phase 1 of the registration, Phase 2 instructions will be sent to your email after you complete the steps below.

Step-by-step guide for PhilHealth Online Registration

Step 1: Access the PhilHealth Electronic Registration System

- Open your browser and go to the official PhilHealth Member Portal. (https://memberinquiry.philhealth.gov.ph/member/)

- On the homepage, find and click on PhilHealth Member Registration at the bottom.

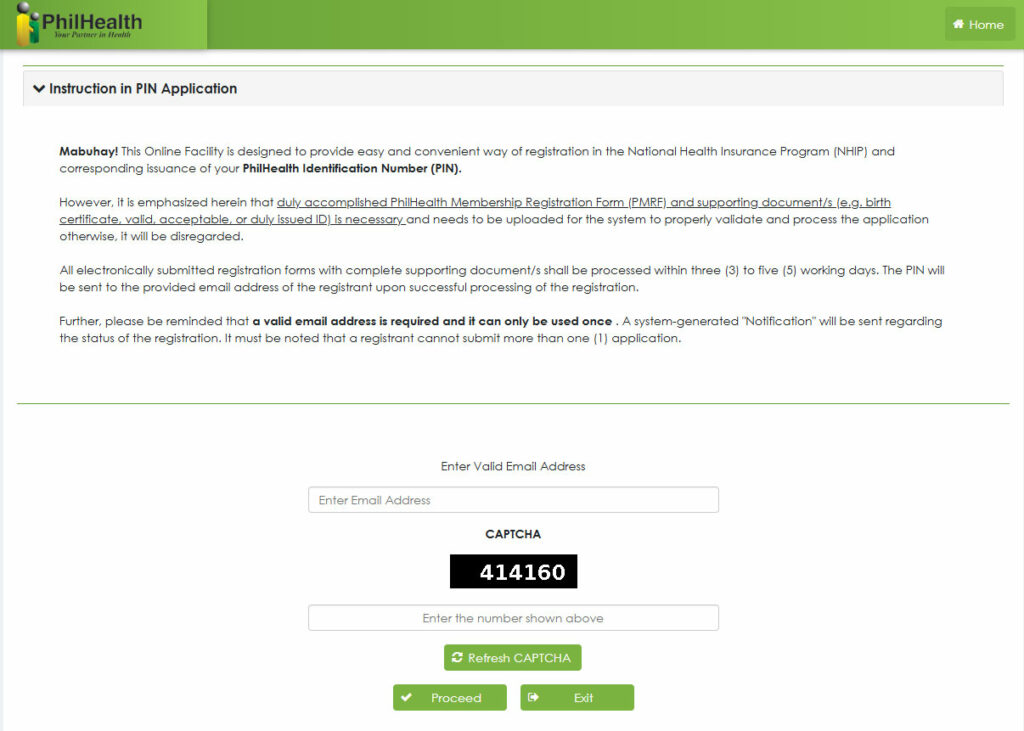

Carefully read the Instructions in PIN Application then enter your valid email address. Make sure that you can open the email that you provide, PhilHealth will send a confirmation link to your email to proceed with the application.

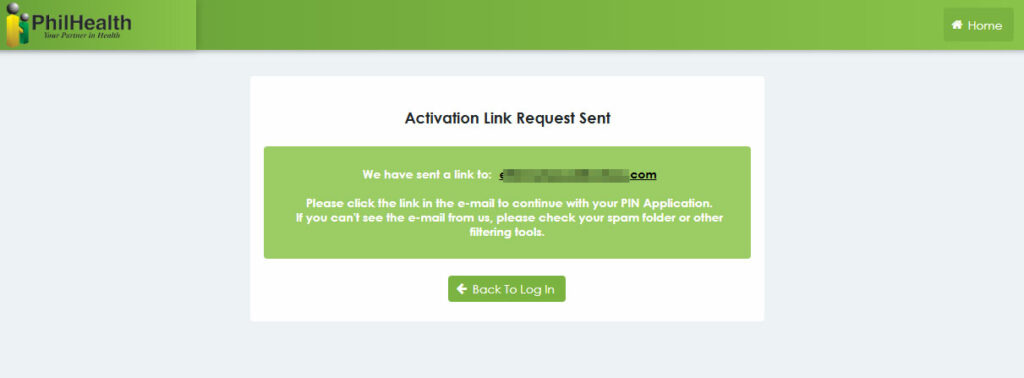

An Activation link will be sent to your email.

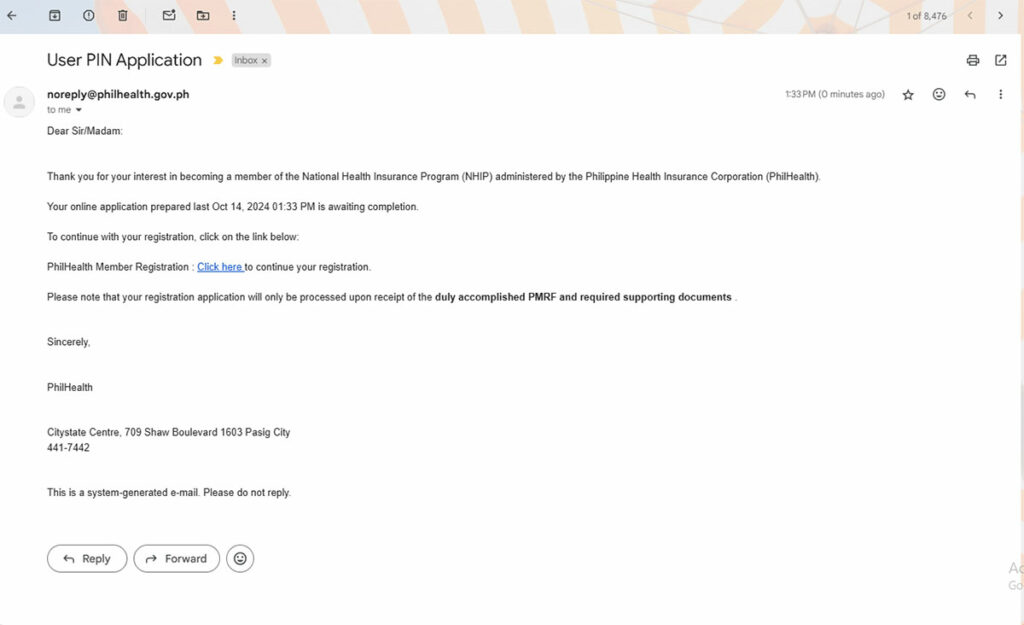

Open your email then click the PhilHealth Member Registration link to continue.

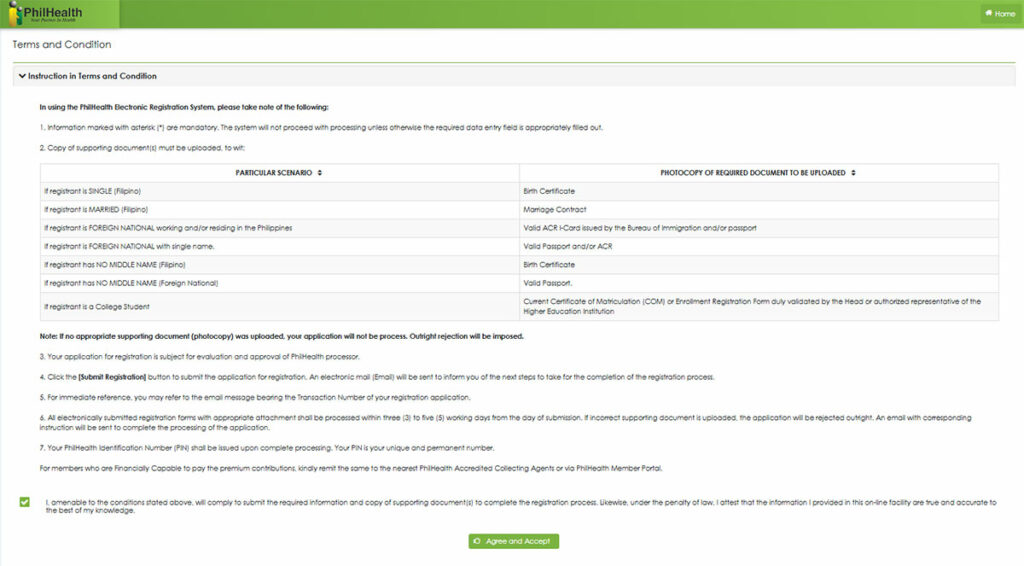

Read the Terms and Conditions carefully, then tick the checkbox to agree and click the “Agree and Accept” button.

Step 2: Fill in the Registration Form

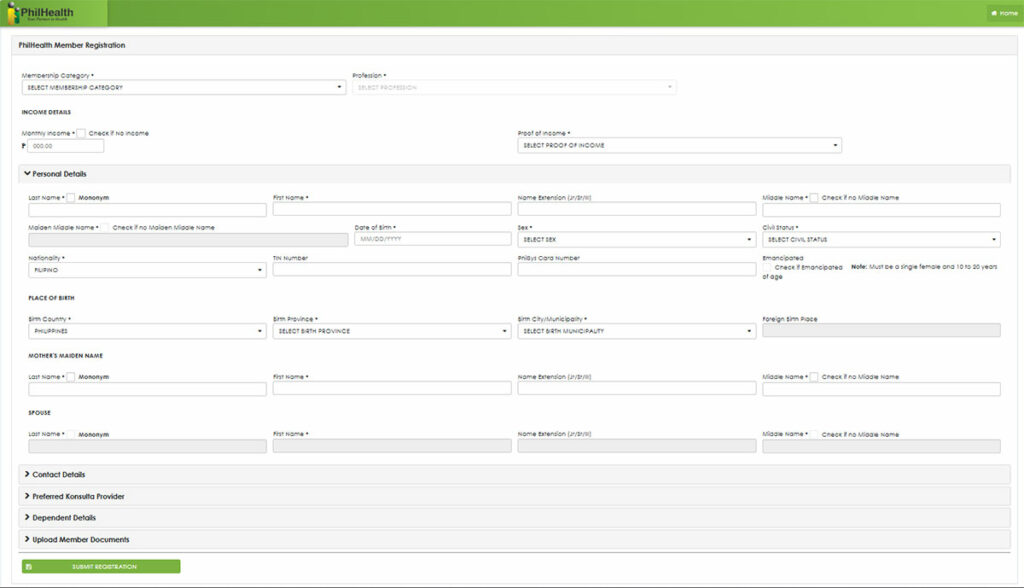

You will arrive at PhilHealth Member Registration Form (PMRF), fill it out completely make sure it is consistent with your other credentials to avoid problems in the future. Don’t leave the field blank especially the one with (*) asterisk. You cannot submit the form if it is incomplete.

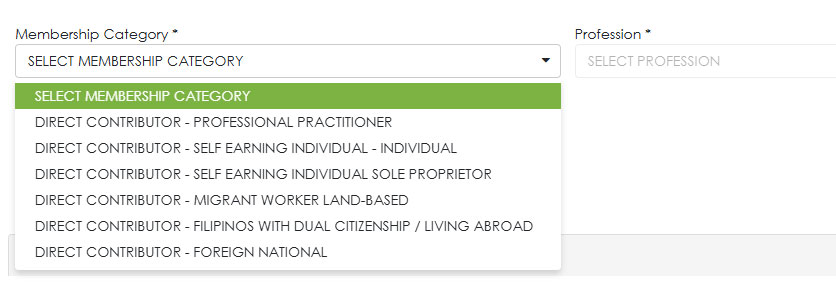

Select Membership Category: Professional Practitioner, Self Earning Individual (Individual & Sole Proprietor), etc. Select which suits you.

Provide your basic personal information such as:

- Name (first, middle, and last name)

- Date of Birth

- Gender

- Civil Status

- Nationality

- Address (permanent residence and current address, if different)

- Contact Information (email address and mobile number)

- Preferred Konsulta provider, you can put here the hospital that is near to your place or your preferred hospital

- Enter your Dependents or Beneficiaries

Upload a scanned copy of a valid ID (e.g., Passport, Driver’s License, or National ID) and Birth Certificate to verify your identity.

Step 3: Review and Submit Your Application

- Carefully review all the details you have entered to ensure accuracy.

- Once everything is in order, click on the Submit Registration button.

- A confirmation page will appear, stating that your registration has been successfully submitted. You will also receive a Reference Number via email, which will serve as proof of your application.

Step 4: Wait for Your PhilHealth Identification Number (PIN)

- After your application has been processed, you will receive your PhilHealth Identification Number (PIN) via email.

- The processing time can vary, but it usually takes a few days to a week. Be sure to regularly check your email for updates.

Step 5: Pay Your PhilHealth Premium (For Voluntary and Self-employed Members)

If you are self-employed or voluntarily registering, you will need to pay the premium contributions. Payment can be made online through the following channels:

- PhilHealth partner banks (e.g., Landbank, UnionBank)

- E-wallets (e.g., GCash, PayMaya)

- Bayad Centers or SM Payment Centers

For employed individuals, your employer will automatically deduct and remit your contributions to PhilHealth.

Benefits of Being a PhilHealth Member

- Inpatient Benefits: PhilHealth covers a portion of hospitalization costs, including room and board, medicines, diagnostics, and professional fees for surgeries and procedures in accredited hospitals.

- Outpatient Benefits: Members can avail of services such as day surgeries, consultations, and treatments without being admitted to a hospital. Some outpatient benefits include laboratory tests and diagnostic procedures.

- Maternity Benefits: Financial assistance for childbirth-related expenses, including normal deliveries, caesarean sections, and complicated cases like ectopic pregnancies.

- Z Benefits Package: Coverage for serious and catastrophic illnesses such as cancer, heart diseases, and kidney failure. This helps in reducing the financial burden of high-cost treatments.

- Senior Citizens and Lifetime Members: Senior citizens automatically qualify for PhilHealth coverage, while lifetime members—those who have paid at least 120 monthly contributions—continue to enjoy benefits without paying further premiums.

- OFW and Overseas Benefits: Overseas Filipino Workers (OFWs) are covered by PhilHealth and can avail of benefits for treatments and hospitalizations abroad or upon return to the Philippines.

- Konsulta Package: PhilHealth’s Primary Care Benefit (PCB) package offers free consultations, diagnostics, and medications for common illnesses.

- Dialysis Benefits: Coverage for up to 144 dialysis sessions per year, significantly reducing the cost of treatment for those with chronic kidney disease.

- Disaster and Crisis Response: PhilHealth extends coverage for members affected by natural disasters or health crises, ensuring they can access medical services even in challenging times.

- Affordable Contributions: For self-employed or voluntary members, the premium contributions are affordable and flexible, making it easier to maintain health insurance coverage.

PhilHealth membership ensures Filipinos can access essential healthcare services at reduced costs, easing the financial burden of medical treatments and improving overall health outcomes.

Read Also: How to Check PhilHealth Contribution Online

That is a really good tip especially to those new to the blogosphere.

Short but very accurate info… Many thanks for sharing this one.

A must read article!