How easy and convenient if your financial transactions are only a click away? Like paying your monthly bills, loading your phone, sending money to your family, transferring funds to another bank account, etc. This is what Banco de Oro (BDO) Online Banking is all about.

If you have an account in BDO you can easily register for online banking and take advantage of their online banking services.

Using BDO online banking you can do almost everything with your money without leaving it in front of your computer. As I mentioned above, you can transfer funds to another local bank account, it’s very convenient and hassle-free since you don’t need to withdraw your money and then deposit it to another bank.

The only disadvantage of transferring funds to another bank account online is the service charge which, if you do it manually it’s free.

There’s a service charge of Php 25.00 for every transfer that you make using BDO Online banking. If you don’t want to pay the service charge, you can do it manually, but you also pay for your fare if the bank is far from your place and the time that you waste when you go out.

If you want to make an online transfer, this article will show you every step, just follow along, I also included a screenshot in every step.

How to Transfer Funds to Other Local Bank using BDO Online Banking

To transfer funds to another local bank account using BDO Online Banking, follow these steps:

1. Log in to BDO Online Banking

- Visit the BDO website https://online.bdo.com.ph/

- Enter your User ID and Password, then click Login.

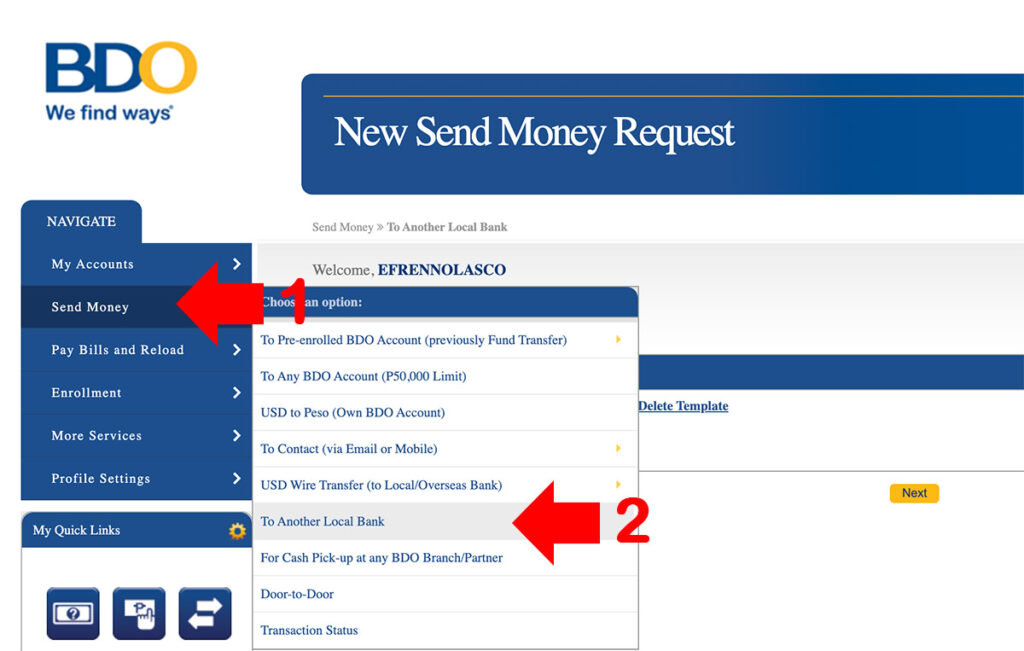

2. Go to “Send Money” Option

- Once logged in, go to the Send Money tab in the navigation menu.

- Under “Send Money,” choose the option “To Another Local Bank”

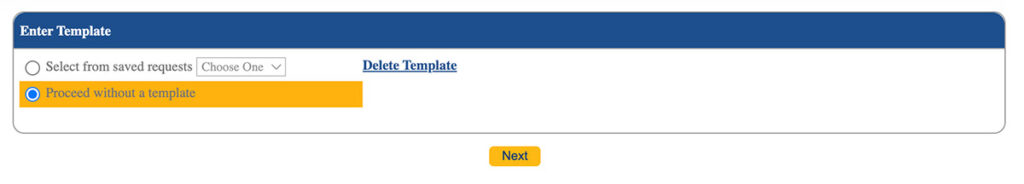

3. Select Transfer Template

If you already transferred and saved the details, you can select from the template, if you are the first time to transfer you can proceed without the template.

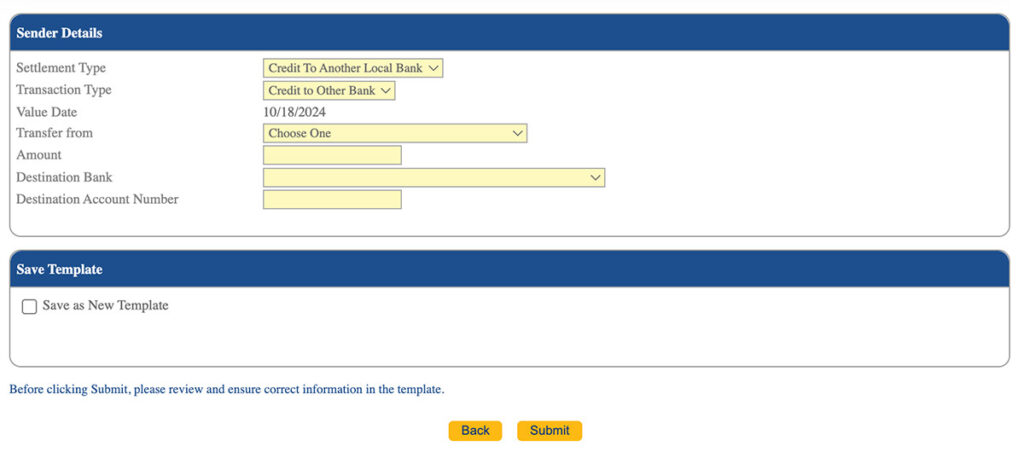

4. Fill in the Transfer Details

- Destination Bank: Select the bank where you want to send the money from the list of local banks.

- Destination Account Number: Enter the account number of another local bank that you want to transfer.

- Amount: Enter the amount you want to transfer.

- Transfer From: This is your BDO account where the funds will be deducted

6. Review the Details

- Double-check the recipient’s account number, bank name, and amount to ensure everything is correct.

7. Confirm the Transfer

- Once you have reviewed the information, click Submit or Confirm.

- You may be asked to input a One-Time Password (OTP), which will be sent to your registered mobile number or email.

- Enter the OTP to finalize the transaction.

8. Receive a Confirmation

- After successfully completing the transfer, you will receive a confirmation message on the screen and an email or SMS confirming the details of your transaction.

Key Points

- Instapay transfers are processed in real-time but usually come with a higher fee (around ₱25).

- PESONet transfers may take up to the next banking day but are often cheaper or free for larger amounts.

- Make sure the recipient’s bank account details are accurate, as incorrect information may delay the transfer or cause it to fail.

Frequently Ask Questions (FAQ)

1. What details do I need to transfer funds to another bank?

You need:

- The recipient’s bank name.

- The recipient’s account number.

- The amount to be transferred.

- Sometimes, the recipient’s full name or other identifying details.

2. How long does it take to transfer funds to another local bank?

- InstaPay: The transfer is typically processed immediately or within a few minutes.

- PESONet: Transfers made before the cut-off (usually around 3 PM on banking days) are processed within the same day, otherwise by the next banking day.

3. What is the transaction limit for transferring funds?

- InstaPay has a limit of ₱50,000 per transaction.

- PESONet generally has no limit, but some banks may impose internal transfer caps.

4. What happens if I enter incorrect details when transferring funds?

If incorrect details (such as the account number or bank name) are provided, the transaction may fail or the funds may be transferred to the wrong account. In such cases, you may need to contact BDO or the recipient bank to try to reverse the transaction, though this process may take time and is not always guaranteed.

5. Can I transfer funds to any bank in the Philippines?

Yes, BDO allows you to transfer to most major banks and financial institutions in the Philippines through either InstaPay or PESONet.

6. Is transferring funds online secure?

Yes, BDO uses encryption, secure authentication (including One-Time Passwords or OTPs), and other security measures to protect online transactions. However, it’s important to ensure that your account credentials and OTPs are not shared with others.

7. Can I schedule a future-dated transfer?

Currently, BDO does not offer the option to schedule future-dated transfers via InstaPay or PESONet. However, you can set up scheduled transfers for BDO-to-BDO accounts.

8. How do I check if my transfer was successful?

After confirming the transfer, you will receive an email or SMS notification. You can also check the status of the transaction through your Transaction History in BDO Online Banking or the BDO mobile app.

9. Can I cancel a fund transfer after it’s been processed?

Once a transfer has been processed through InstaPay or PESONet, it cannot be canceled. If the transaction is still pending, you may need to contact BDO customer service for assistance.

10. What are the daily transaction limits for BDO online transfers?

Daily transaction limits depend on your account type and settings. Typically, for retail customers, the daily limit is ₱50,000.

14. What should I do if I don’t receive a confirmation or if the funds don’t arrive?

If you don’t receive confirmation or the recipient hasn’t received the funds, check your transaction history or contact BDO customer service for assistance. In the case of PESONet transfers, delays may occur due to processing schedules.

15. Can I transfer to e-wallets (e.g., GCash, PayMaya) using BDO Online Banking?

Yes, you can use the InstaPay option to transfer funds from BDO to e-wallets like GCash or PayMaya, as these are listed among local banks and financial institutions in the options.