If you’re planning to be an online worker or an online shopper, you need to get a PayPal account. You can easily make secure transactions online if you use PayPal.

Unlike revealing your debit/credit card number to the online stores when you buy items, using PayPal, you only need to enter the email address and password. You can also receive money using PayPal, this is very convenient, especially for online workers because most online employers prefer to use PayPal to pay their employees.

Withdrawing PayPal funds in the Philippines is a straightforward process, thanks to multiple options for transferring your money. Here’s a step-by-step guide to help you withdraw funds from your PayPal account in the Philippines.

Step 1: Link a Bank Account or Debit Card to PayPal

Before you can withdraw funds, you need to link a bank account or a Visa/Mastercard debit card to your PayPal account. Here’s how:

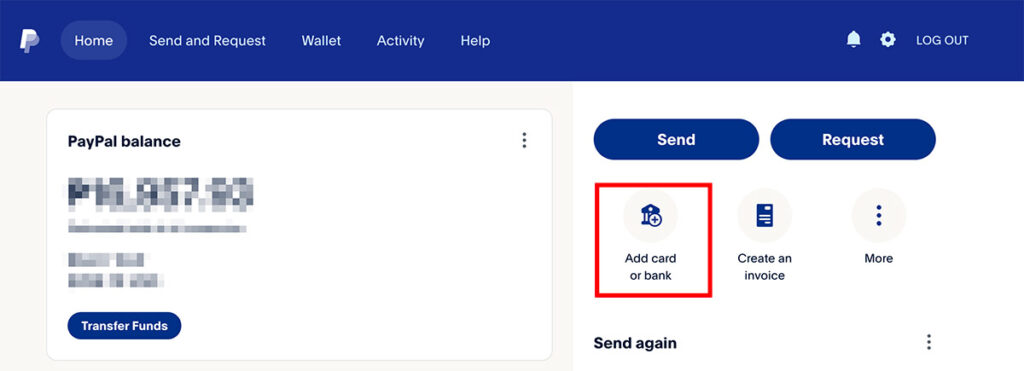

- Log in to Your PayPal Account: Go to the PayPal website and log in with your username and password.

- Add Card or Bank: At the home page click the Add Card or Bank icon at the right part of the screen just below the send and request button.

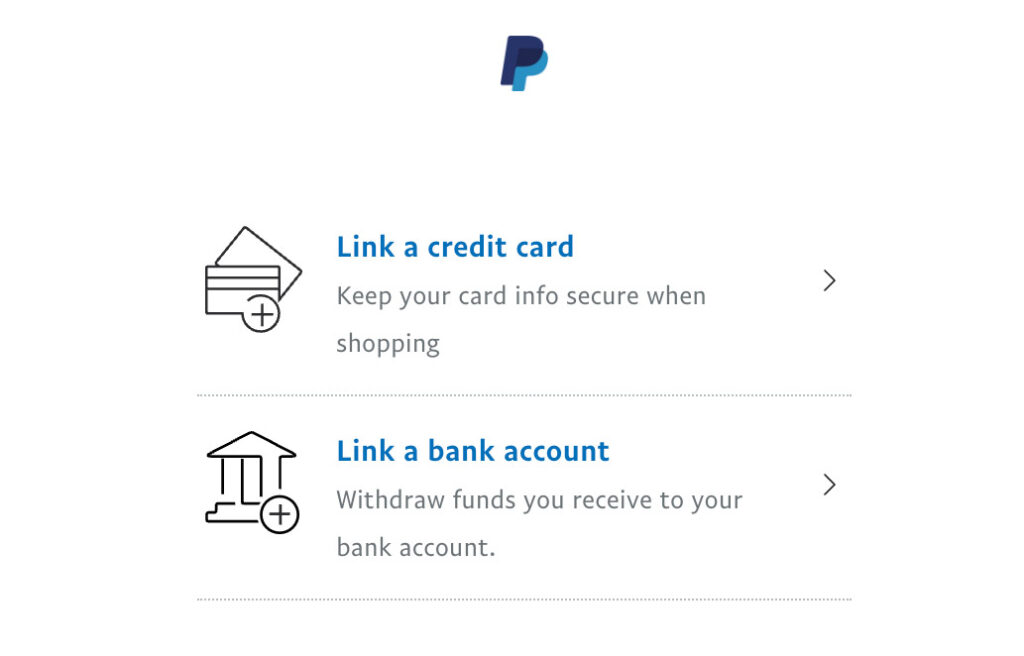

- Link a New Bank or Card:

- For a Bank Account: Under “Money, banks, and cards,” click Link a bank account. Enter your bank details (You need to Enter Bank Name, Bank Code and Bank Account Number).

- For a Credit Card: Click Link a credit card instead. Provide your credit card details, including the card number, expiration date, and CVV code.

Note: Make sure the name on your PayPal account matches the name on your bank account or card to avoid any issues during the transfer.

- Confirm and Save: Once you’ve entered your details, confirm the information and save.

Step 2: Choose Your Withdrawal Method

There are three main ways to withdraw PayPal funds in the Philippines:

- Transfer to a Local Bank Account: This option typically takes 2-4 business days.

- Withdraw to a Visa Debit or Prepaid Card: This option is faster but may incur additional fees.

- Transfer to GCash: GCash is a popular e-wallet in the Philippines that allows instant withdrawals from PayPal.

Let’s go through each method in detail.

Method 1: Withdraw PayPal Funds to a Local Bank Account

- Log in to Your PayPal Account: Below your Paypal balance, click the “Transfer Funds” button

- Choose the Bank Account: Choose the bank account where you want to transfer your funds.

- Select the Amount to Withdraw: Enter the amount you’d like to transfer to your bank account. Be aware of any minimum withdrawal amounts if applicable. If you have different currencies select PHP.

- Review and Confirm: Review the transfer details, including any fees that may apply, and click Transfer.

- Wait for Processing: Transfers to local bank accounts usually take 2-4 business days, depending on the bank.

Fees and Tips for Bank Transfers

- Fee: PayPal charges a withdrawal fee of PHP 50 for amounts under PHP 7,000. For transfers over PHP 7,000, the fee is waived.

- Exchange Rate: PayPal applies its own exchange rate if you’re transferring foreign currency, which may be slightly lower than the prevailing market rate.

- Tips: Choose a larger amount to withdraw to avoid paying the fee.

Method 2: Withdraw PayPal Funds to a Visa Debit or Prepaid Card

- Log in to Your PayPal Account: Below your Paypal balance, click the “Transfer Funds” button

- Choose Your Card: Pick the Visa card you linked earlier.

- Enter the Amount: Type in the amount you want to withdraw.

- Review and Confirm: Look over the transfer details, including the fees, and click Transfer.

- Receive Funds: Withdrawals to Visa cards are usually faster, typically in minutes but with 1% fee.

Fees and Considerations for Card Transfers

- Fee: PayPal charges 1% of withdrawal amount.

- Speed: Visa withdrawals are generally faster than bank transfers, but they’re more expensive.

- Tip: Use this option if you need faster access to your funds and are willing to pay the higher fee.

Method 3: Transfer PayPal Funds to GCash

To use this method, you need a GCash account linked to your PayPal. Here’s how to set it up and withdraw funds:

Link GCash to PayPal

- Log in to the GCash App: Open the GCash app on your mobile device.

- Access PayPal Linking: Go to Profile > My Linked Accounts > PayPal.

- Link Your PayPal Account: Enter your PayPal email address and authorize the link.

Transfer Funds to GCash

- Log in to the GCash App: Once your accounts are linked, log in to the GCash app.

- Go to Cash-In Options: Tap Cash In, then select PayPal as your funding source.

- Enter the Amount: Type in the amount you want to withdraw to GCash. The funds will be transferred almost instantly.

- Confirm the Transaction: Review the transaction details and confirm.

Fees and Considerations for GCash Withdrawals

- Fee: Starting March 4, 2024 GCash charges 1% of the Cash In Amount.

- Speed: Transfers to GCash are instant, making this one of the fastest withdrawal methods.

- Tip: This option is ideal if you need quick access to funds without incurring high fees.

Withdrawing PayPal funds in the Philippines is a straightforward process, thanks to multiple options for transferring your money. Here’s a step-by-step guide to help you withdraw funds from your PayPal account in the Philippines:

Fees and Considerations for GCash Withdrawals

- Fee: PayPal does not charge a fee to transfer to GCash, but GCash may charge a withdrawal fee if you cash out from GCash to a bank.

- Speed: Transfers to GCash are instant, making this one of the fastest withdrawal methods.

- Tip: This option is ideal if you need quick access to funds without incurring high fees.

Step 3: Track Your Withdrawal

After making a withdrawal, you can monitor the status of your transfer in PayPal:

- Log in to PayPal: Access your account on the PayPal website.

- Go to Activity: Click on Activity to see recent transactions, including your withdrawal request.

- Check the Status: Your withdrawal should show as Completed once the funds have been sent.

Frequently Asked Questions

1. How long does it take to withdraw PayPal funds in the Philippines?

Withdrawal times vary based on the method:

- Bank Transfers: 2-4 business days.

- Visa Card Transfers: Within minutes

- GCash Transfers: Instant.

2. What are the fees for withdrawing PayPal funds?

- Bank Transfer: PHP 50 (waived for amounts over PHP 7,000).

- Visa Card: 1% Fee

- GCash: 1% of Cash In Amount.

3. Are there any minimum withdrawal amounts?

- Yes, PayPal generally requires a minimum withdrawal amount of PHP 500 for transfers to a local bank.

By following these steps, you can easily withdraw your PayPal funds in the Philippines, choosing the option that best suits your needs for speed and cost-effectiveness.

More Informative articles on EfrenNolasco.com

- How to Open PayPal account in the Philippines and get Verified

- How to Sent payment on PayPal without charge

- How to get UnionBank EON Card