Investing is one of the best ways to grow your wealth and achieve financial freedom. If you’re a beginner looking for the best investment options in the Philippines, this guide will help you understand the available choices and how to start your investment journey with confidence.

Why Invest in the Philippines?

The Philippines is one of the fastest-growing economies in Southeast Asia, with a strong consumer base, a young workforce, and a thriving digital economy. Investing early allows you to take advantage of these opportunities while securing your financial future.

Factors to Consider Before Investing

Before diving into investment options, consider the following:

- Risk Tolerance – Understand your capacity to handle losses.

- Investment Goals – Are you saving for retirement, a house, or passive income?

- Time Horizon – How long can you keep your money invested?

- Liquidity Needs – Do you need quick access to your funds?

- Knowledge and Experience – Start with investments that match your understanding.

Best Investment Options for Beginners in the Philippines

1. Savings Accounts and Time Deposits

If you’re new to investing, a high-yield savings account or a time deposit is a great way to start. These options provide:

- Low risk

- Guaranteed returns

- Easy access to funds (for savings accounts)

Banks like BDO, BPI, and Metrobank offer competitive interest rates for time deposits. However, the returns are relatively low compared to other investments.

2. Stock Market

Investing in the Philippine Stock Exchange (PSE) can be rewarding but requires knowledge and patience. Beginners can start by:

- Opening an account with online brokers like COL Financial, First Metro Securities, or BDO Nomura.

- Investing in blue-chip stocks such as Ayala Corporation, SM Investments, or Jollibee Foods.

- Using a long-term strategy like peso-cost averaging to reduce risks.

Read: How to Invest or Buy Stocks in the Philippines Stock Market

3. Mutual Funds and UITFs (Unit Investment Trust Funds)

If you want to invest in stocks or bonds but don’t have the time to manage them, consider mutual funds or UITFs. These are managed by professionals and offer diversification. Popular providers include:

- BDO, BPI, and Metrobank UITFs

- PhilEquity Fund and Sun Life Mutual Funds

Mutual funds and UITFs are great investment options for beginners who prefer a hands-off approach.

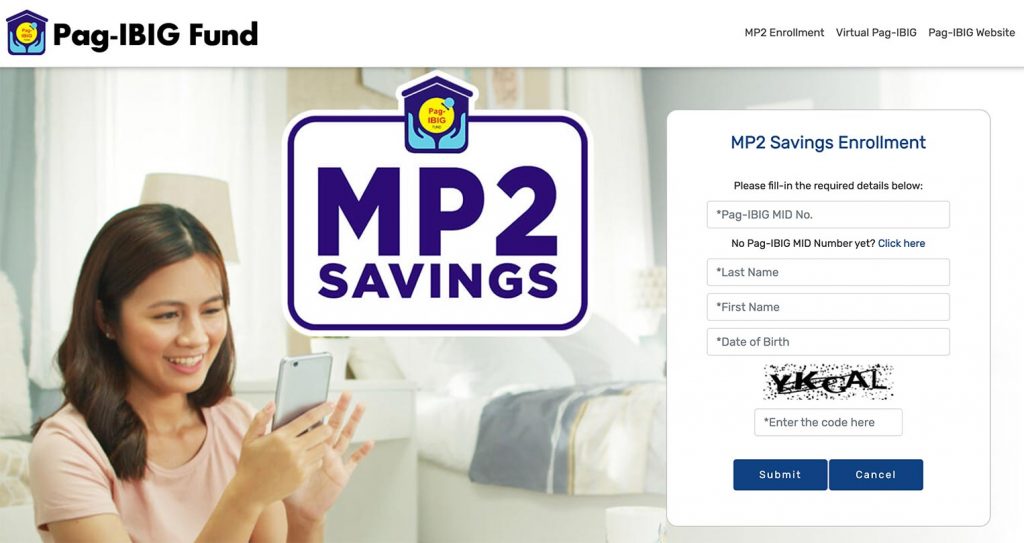

4. Pag-IBIG MP2 Savings Program

For those looking for low-risk and government-backed investments, the Pag-IBIG MP2 Savings Program is an excellent choice. It offers:

- Higher dividends than regular savings accounts

- Tax-free earnings

- Five-year lock-in period, with flexible contribution amounts

5. SSS Peso Fund and WISP (Workers’ Investment and Savings Program)

If you’re a member of the Social Security System (SSS), you can take advantage of the SSS Peso Fund and WISP. These voluntary savings programs provide:

- Higher returns than regular SSS contributions

- Tax-free earnings

- Retirement benefits

6. Real Estate Investments

Real estate is one of the best long-term investment options in the Philippines. You can invest in:

- Rental Properties – Buy a condominium or house and rent it out.

- Real Estate Investment Trusts (REITs) – Invest in properties without owning them directly. REITs available in the Philippines include Ayala REIT and Filinvest REIT.

Real estate investments require a higher capital but can provide passive income and long-term appreciation.

Read: How To Invest In Real Estate: Everything You Need To Know

7. Government Bonds and Corporate Bonds

Bonds are a low-risk investment option where you lend money to the government or corporations in exchange for periodic interest payments. Some options include:

- Retail Treasury Bonds (RTBs) – Issued by the Philippine government.

- Corporate Bonds – Offered by companies like Ayala, SM, or San Miguel.

Bonds are ideal for conservative investors looking for stable returns.

8. Cryptocurrency and Digital Assets

For tech-savvy investors, cryptocurrencies like Bitcoin and Ethereum offer high-risk, high-reward opportunities. Beginners can start by:

- Using local exchanges like Coins.ph or PDAX.

- Investing small amounts to minimize risks.

- Researching before trading or holding crypto assets.

While cryptocurrency can be volatile, it is a growing market worth exploring for diversification.

Raed: Cryptocurrency Terms 101

9. Peer-to-Peer Lending and Crowdfunding

If you’re interested in earning interest by lending money, platforms like SeedIn, FundKo, and Flint allow you to invest in peer-to-peer lending and crowdfunding. These options provide:

- Higher returns than traditional bank deposits.

- A chance to support small businesses and real estate projects.

However, be aware of the risks involved in lending money to individuals or startups.

10. Index Funds and ETFs (Exchange-Traded Funds)

Index funds and ETFs are great investment options for beginners who want diversified exposure to the stock market. In the Philippines, options include:

- First Metro Philippine Equity Exchange-Traded Fund (FMETF)

- Index Funds offered by major banks and investment firms

These funds track the performance of the PSE index and are ideal for long-term investors.

How to Get Started with Investing

If you’re ready to start investing, follow these steps:

- Set Your Financial Goals – Define what you want to achieve.

- Educate Yourself – Learn about different investment options.

- Start Small – Begin with a manageable amount.

- Diversify Your Investments – Don’t put all your money in one option.

- Monitor Your Portfolio – Review and adjust your investments regularly.

Conclusion

Choosing the right investment options in the Philippines depends on your financial goals, risk tolerance, and investment knowledge. Beginners can start with low-risk investments like savings accounts, Pag-IBIG MP2, or government bonds before exploring stocks, mutual funds, and real estate. By taking a strategic approach, you can grow your wealth and secure a better financial future.

Check Also: Compound Interest Calculator: How to Calculate Your Investment Growth