Loans are an essential part of personal finance for many people, whether it’s for purchasing a home, starting a business, or funding higher education. However, when taking out a loan, it’s important to understand how the loan repayments will be structured, including the breakdown of principal and interest.

Loan Calculator (Philippines)

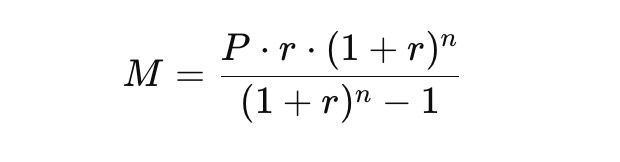

Monthly Payment Formula

The monthly payment for a loan is calculated using the amortization formula:

Where:

- 𝑀: Monthly payment

- 𝘗: Loan amount (Principal)

- 𝑟: Monthly interest rate (as a decimal, i.e., 2% = 0.02)

- 𝓃: Total number of months (Loan term)

Explanation:

- Numerator: (𝘗 ﹒ 𝑟 ﹒(1 + r )𝓃 ) : Calculates the total loan amount adjusted by the interest rate over time.

- Denominator: ((1 + r )𝓃 − 1) : Distributes the loan payments evenly over the loan term

Amortization Table

The monthly payment is broken down into:

Interest Payment: The portion of the monthly payment that goes toward paying the interest on the remaining loan balance.

Formula: Interest Payment = Remaining Balance ﹒ 𝑟

Principal Payment: The portion of the monthly payment that reduces the loan balance.

Formula: Principal Payment = 𝑀 – Interest Payment

After each month:

The Remaining Balance is updated by subtracting the principal payment.

Formula: Remaining Balance = Remaining Balance (previous) – Principal Payment

How to Use the Loan Calculator

Using the Loan Calculator with Amortization Table is simple and straightforward. Here are the steps you need to follow:

1. Enter the Loan Amount:

- In the first input field, enter the Loan Amount (₱). This is the total amount you are borrowing. It could be the cost of a car, a home, or any other loan you’re considering.

- For example, if you’re borrowing ₱500,000 for a home loan, you would input

500000, it will automatically add commas “,”

2. Input the Monthly Interest Rate:

- Next, enter the Monthly Interest Rate (%) in the second field. This rate is typically provided by the lender and may be an annual rate divided by 12 to get the monthly rate.

- For example, if the annual interest rate is 18%, enter

1.5(since 18% / 12 months = 1.5%).

3. Set the Loan Term in Months:

- In the third input field, input the Loan Term (Months). This is how long you’ll take to repay the loan, typically ranging from 12 months to 240 months (20 years) or more, depending on the type of loan.

- For example, if you are taking a 10-year loan, you would input

120(since 10 years = 120 months).

4. Click the “Calculate” Button:

Once all the fields are filled out, click the “Calculate” button. The calculator will then generate a detailed amortization table.

5. Review the Amortization Table:

After clicking the “Calculate” button, the amortization table will appear, showing the breakdown of each payment over the life of the loan. The table will include:

- Monthly Payment: The fixed amount you will pay each month.

- Interest Payment: How much of each payment goes toward paying interest.

- Principal Payment: How much goes toward reducing your loan principal.

- Remaining Balance: The outstanding balance after each monthly payment.

6. Analyze the Results:

Review the Amortization Table to see how the loan will be repaid over time. The table helps you understand the distribution of interest and principal payments and how the loan balance decreases with each payment.

What is a Loan Amortization?

Amortization refers to the process of spreading out a loan into a series of fixed monthly payments. The monthly payment includes two components:

- Principal Payment: The portion of the payment that reduces the outstanding balance of the loan.

- Interest Payment: The portion of the payment that covers the cost of borrowing money, based on the interest rate.

Over time, as the principal balance decreases, the interest portion of each payment becomes smaller, while the principal portion increases. This gradual shift is what the Amortization Table helps visualize.

Why is an Amortization Table Important?

An Amortization Table provides a detailed monthly breakdown of the loan repayment schedule, allowing the borrower to understand:

- How much of each payment goes toward the interest and principal.

- How the remaining loan balance decreases with each payment.

- The total interest paid over the life of the loan.

It’s especially useful for:

- Managing finances: Knowing exactly how much will be paid each month helps plan budgets effectively.

- Interest insights: Helps visualize how much interest will be paid over time and how the interest decreases as the principal balance decreases.

Features of the Loan Calculator

This Loan Calculator with Amortization Table is specifically designed for users in the Philippines, and here’s what makes it stand out:

1. User Inputs

To use the loan calculator, you’ll need to input the following information:

- Loan Amount (₱): The total amount borrowed.

- Monthly Interest Rate (%): The interest rate applied on the loan every month. This is a crucial factor in determining how much you’ll pay in interest over the life of the loan.

- Loan Term (Months): The duration over which you’ll repay the loan. The loan term typically varies from a few months to several years.

2. Amortization Breakdown

Once the user inputs the values, the calculator computes and provides a detailed monthly repayment schedule in the form of an amortization table. The table includes:

- Monthly Payment: The fixed monthly amount to be paid for the entire loan term.

- Interest Payment: The amount of the monthly payment that goes toward paying the interest on the loan.

- Principal Payment: The portion of the payment that reduces the principal balance.

- Remaining Balance: The outstanding loan balance after each payment.

Each month’s row in the table shows the breakdown for that month, giving the borrower a complete picture of how their loan will be repaid over time.

3. Currency Formatting (₱)

The calculator is specifically tailored for users in the Philippines. As such, all amounts are formatted in Philippine Peso (₱), making it easier for Filipinos to understand their loan payments in their local currency.

4. Accurate and Easy-to-Read Results

The loan calculator is designed to provide results that are:

- Accurate: It uses the monthly interest rate and loan term to calculate how the loan will be paid off over time.

- Readable: The amortization table is displayed in a tabular format, which makes it easy to see how much will be paid each month and how the loan balance decreases.

Why Use This Calculator?

- Understanding Loan Repayments: It’s vital for borrowers to understand how much they will be paying each month and how much of that will go toward paying down the loan balance and interest. This helps in planning finances.

- Managing Long-Term Debt: The amortization table is particularly useful for those who plan on making extra payments or want to pay off their loan early. It provides clarity on how early payments affect the overall repayment schedule.

- Clear Financial Picture: For Filipinos planning big purchases, this tool helps break down a large loan into manageable pieces, making it easier to understand the impact of borrowing.

Whether you’re applying for a home loan, car loan, or personal loan in the Philippines, understanding your loan terms is crucial. This Loan Calculator with Amortization Table provides a clear and detailed breakdown of your loan, allowing you to see how each monthly payment impacts your loan balance over time. By knowing exactly how much you’ll pay in principal and interest, you can make informed financial decisions, adjust your budget, and even accelerate your loan repayment.

Disclaimer: The results provided by this Loan Calculator are for informational purposes only and should not be considered as financial advice. While we strive for accuracy, the actual loan terms, interest rates, and repayment schedules may vary depending on the lender and your specific financial situation. We recommend consulting with a financial advisor or lending institution to get precise loan details before making any financial decisions.