Nowadays, it is inevitable to borrow money from online loans especially in times of emergencies come and sudden expenses are at stake. Online loans in the Philippines are salient- however, the key is identifying whether it is legitimate or not- hence, the list we are about to give you is online loans in the Philippines that are registered with the Securities and Exchange Commission (SEC).

These online loans are often availed by most Filipinos because of its convenience, ease of application process, minimal requirements, and speed of approval unlike from banks and government agencies that require lengthy process and tight requirements.

You may try these online loans if you need urgent cash but we encourage you to familiarize yourself first on how these online loans work including their loan amounts, loan terms, and repayment plans, among others.

Online Loans in the Philippines

Online loans are non-traditional loans from private lenders which operate over the internet, usually they process loan applications through mobile apps or websites.

While bank and government loans conducts credit history to know if the borrowers have the ability to pay, online loans don’t and typically require one valid ID and proof of income.

After completion of loan applications, notification of approval are received by borrowers within 24 hours, reflecting the amount in their chosen outlets, hence, repayments are made via the online loans’ partner banks and remittance centers.

Pros and Cons of Online Loans

Pros

- You may apply for loans anytime as they process loan applications 24/7.

- You only need minimal eligibility and document requirements such as valid ID and proof of income.

- You may apply for loans anywhere using your smartphone or computer.

- You may get your loans approved within 24 hours, sometimes the amount are even credited real-time.

- You will not need bank accounts anymore (although some do) but mostly, amounts are often disbursed through their partner remittance centers such as GCash, PayMaya, and such.

Cons

- You may accumulate high interest rates if you don’t pay on time.

- You may only get short-term loans which are payable on the 7th day, every 15th day, or at the end of the month. Beyond one month comes with higher charges and interest rates.

- You are susceptible to online scammers, don’t worry though because the list we have are legitimate.

- You may experience harassment from online lenders if your loans go unpaid (this is punishable by law).

Read: Comparing Different Car Loans from Different Banks Through Loan Calculators

List of Legit Online Loans in the Philippines

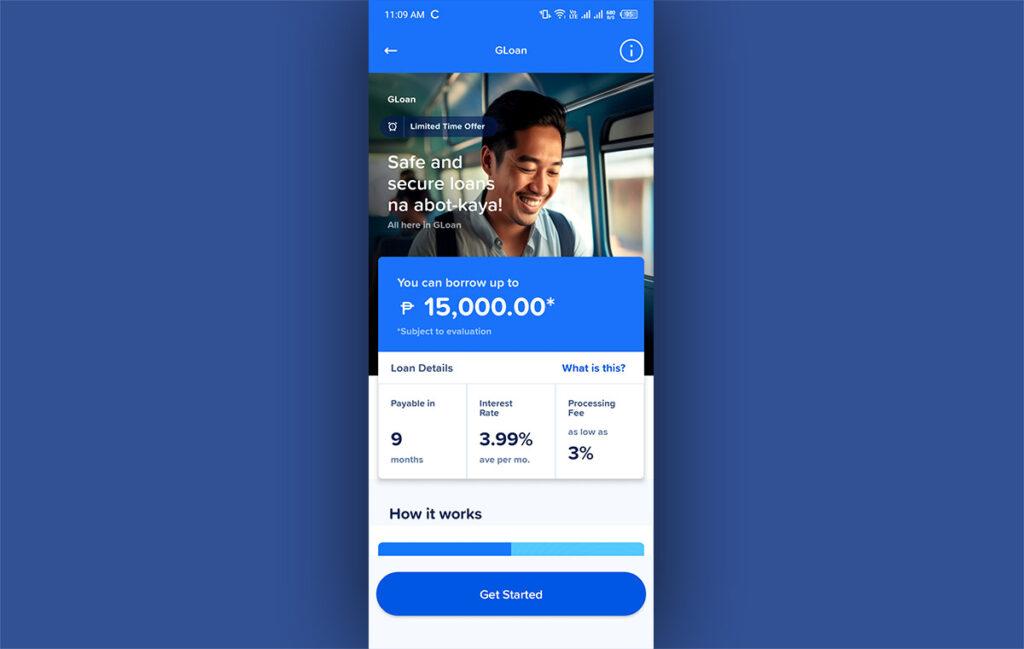

1. GLoan by GCash

GLoan is a digital loan service offered by GCash in the Philippines, designed to provide quick, hassle-free loans directly through the GCash app. This service allows eligible GCash users to borrow funds for various personal needs, such as covering expenses, paying bills, or making larger purchases, without traditional bank requirements. With an easy application process, instant approval, and flexible repayment terms, GLoan offers a convenient financing option that fits seamlessly into users’ digital wallets. By providing clear fees and a transparent structure, GLoan aims to make borrowing accessible and straightforward for Filipinos.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| GLoan | Up to ₱125,000 | Five to 24 months | 1.59% to 6.99% |

Qualifications and Documents:

| |||

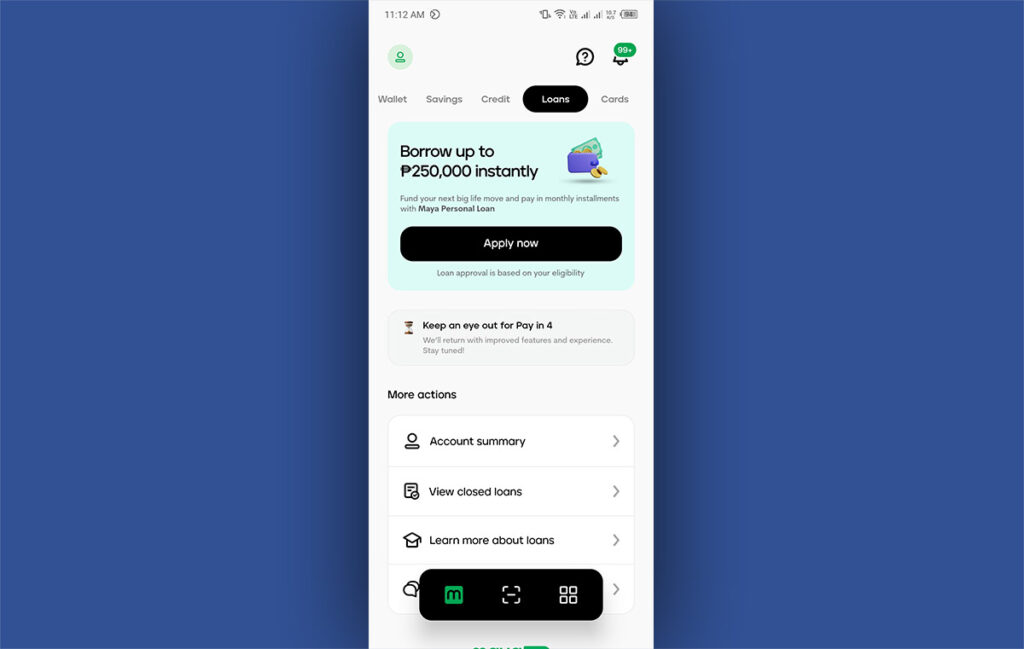

2. Maya Loan

Maya Loan is a digital lending service offered by Maya, a financial technology platform, primarily operating in the Philippines. It provides quick and convenient access to personal loans for individuals and small businesses through a fully online application process. The service is designed to be user-friendly, with flexible loan amounts, competitive interest rates, and manageable repayment terms. Maya Loan aims to promote financial inclusion by offering credit to users who may not have access to traditional banking services, helping them meet their financial needs or fund various personal or business expenses.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Maya | ₱15,000 to ₱250,000 | Up to 24 months | Starts at 0.83% |

Qualifications and Documents:

| |||

3. Tala Loan

Tala Loan is a mobile-based lending service in the Philippines that offers quick and accessible cash loans to individuals, even those without traditional credit histories. Through the Tala app, users can easily apply for loans ranging from ₱2,000 to ₱25,000, with approvals often processed within minutes.

First-time borrowers can start with amounts up to ₱15,000, while repeat borrowers with a good repayment history may qualify for higher limits. Tala provides flexible repayment terms from 1 to 61 days, with transparent fees and no hidden charges, making it a convenient option for short-term financial needs. With a simple application process requiring only an Android device, a Philippine mobile number, and a valid ID, Tala enables fast cash disbursement through e-wallets, bank transfers, or payment centers.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Tala Loan | Up to ₱25,000 | One to 61 days | 0.43% to 0.5% (daily service fee) |

Qualifications and Documents:

| |||

4. ACOM Cash Loan

ACOM Cash Loan is designed to offer quick and reliable financial assistance to individuals for various needs such as personal expenses, emergencies, or debt consolidation. ACOM provides flexible loan amounts starting from ₱5,000 up to ₱500,000, with convenient repayment terms ranging from 6 to 10 months, depending on the borrower’s financial capacity and eligibility. The application process is straightforward, often requiring only a valid ID and proof of income, making it accessible to a wide range of customers, including those without a credit history. ACOM’s competitive interest rates and commitment to transparency mean that borrowers are fully informed of all fees and charges from the start, ensuring a smooth and reliable borrowing experience.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| ACOM Cash Loan | ₱5,000 to ₱500,000 | Six to 10 months | 4.988% |

Qualifications and Documents:

| |||

5. AEON Personal Loan

AEON Personal Loan is offering flexible loan solutions for various personal needs, such as home improvements, medical expenses, travel, or debt consolidation. The application process is straightforward, requiring basic documents like a valid ID and proof of income, making it accessible even for first-time borrowers. Known for its quick approval times and transparent fees, AEON Personal Loan gives customers a reliable way to access funds with clear terms, making it an ideal choice for those seeking financial flexibility.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| AEON Personal Loan | Will depend on credit evaluation | Six and 12 months |

|

Qualifications and Documents:

| |||

6. Asialink Finance Corporation Loans

Asialink Finance Corporation offers a range of loan options in the Philippines to help with personal and business needs. They provide quick and easy loans, including personal cash loans, business loans, and vehicle financing. With a straightforward application process and flexible repayment terms, Asialink Finance makes it convenient for customers to get the funds they need for expenses, business growth, or buying a vehicle.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Asialink Finance Corporation Loans | Depends on the appraised value of your asset | Up to 48 months for OR/CR Loan and Vehicle Financing; 12 months for Doctor’s Loan | As low as 1.5% for OR/CR Loan and secondhand car loans; 1.75% for Doctor’s Loan |

Qualifications and Documents:

| |||

7. Atome Cash Loan

Atome Cash is a financial service offered by Atome, providing quick and convenient cash loans to users in the Philippines. Through the Atome app, eligible users can apply for loans up to ₱50,000, with monthly interest rates starting at 1.75% and repayment terms extending up to 12 months. This service is designed to offer flexible financial solutions for various needs, including personal expenses and emergencies. Currently, Atome Cash is accessible by invitation only, ensuring a tailored experience for its users

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Atome | ₱500 to ₱50,000 | Up to 12 months | Starts at 1.75% |

Qualifications and Documents:

| |||

8. Blend PH loan

Blend PH Loan is a peer-to-peer lending platform in the Philippines that connects people who need loans with those who want to invest. It offers personal, business, and franchise loans, making borrowing easier and more accessible than traditional banks. Borrowers can quickly apply online, while investors can earn by lending to approved borrowers. Blend PH aims to provide fair, transparent, and secure lending for Filipinos.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Blend PH Loan

|

| One to 36 months | Risk-based interest (1% to 8% per month, depending on the loan)

|

Qualifications and Documents:

| |||

9. Cash Mart Personal Loan

Cash Mart Personal Loan offers quick and easy personal loans to help cover various financial needs. With a simple online application process, Cash Mart makes it convenient for individuals to borrow money for emergencies, bills, or personal expenses. The platform offers flexible loan terms and fast approval, making it a popular choice for those who need fast cash without complicated requirements. Cash Mart aims to provide accessible financial solutions with transparent fees and a hassle-free experience.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Cash Mart Personal Loan | ₱3,000 to ₱150,000 |

| 0.06% to 1% per day, depending on the loan term |

Qualifications and Documents:

| |||

10. Cashalo Cash Loan

Cashalo Cash Loan provides fast and easy loans for individuals looking to cover short-term financial needs. Through the Cashalo app, users can quickly apply for loans, track their application status, and manage repayments all in one place. The platform is designed for convenience, offering flexible loan amounts and terms to fit various budgets and needs. Cashalo focuses on making credit accessible to more Filipinos, providing a secure and transparent process with clear fees and no hidden charges, aiming to promote financial inclusion across the country.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Cashalo Cash Loan | ₱1,000 to ₱7,000 | Up to 90 days | Starts at 3.95% |

Qualifications and Documents:

| |||

11. Digido Instant Online Loan

Digido Instant Online Loan is a quick and convenient loan service in the Philippines that provides instant cash loans through a fully digital process. Designed for those who need funds immediately, Digido offers a simple online application that can be completed in minutes, with fast approval and disbursement. New borrowers can access small loan amounts, while returning clients with good repayment history may qualify for higher limits. With clear terms, flexible repayment options, and no hidden fees, Digido aims to offer a secure and accessible loan option for Filipinos facing urgent financial needs.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Digido Instant Online Loan

| ₱1,000 to ₱25,000 | 7 days to 180 days | 0% for new customers; not more than 1.5% daily for repeat customers |

Qualifications and Documents:

| |||

12. Esquire Financing Business Loan

Esquire Financing Business Loan is a lending solution in the Philippines tailored for small and medium enterprises (SMEs) seeking to grow their business. It provides accessible financing options without the need for collateral, making it ideal for entrepreneurs who need working capital, equipment, or funds to expand operations. Esquire Financing prioritizes fast processing and flexible terms, allowing businesses to get the funds they need without lengthy bank procedures. With a focus on supporting Filipino businesses, Esquire Financing offers a reliable and transparent service to help SMEs achieve their growth goals.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Esquire Financing Business Loan | Up to ₱100 million | 3 months to 2 years | Subject to the lender’s approval, depending on the loan amount and repayment term |

Qualifications and Documents:

| |||

13. Finbro Loan

Finbro Loan is an online lending platform in the Philippines that offers fast, convenient loans for individuals in need of immediate cash. With a quick application process available through their website, Finbro aims to make borrowing easy and accessible, especially for first-time borrowers. Loan approval is usually swift, and funds are disbursed directly to the borrower’s bank account, allowing for prompt financial relief. Finbro is known for transparent fees, flexible repayment terms, and a straightforward process, providing a reliable solution for Filipinos facing short-term financial needs.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Finbro Loan | ₱1,000 to ₱50,000 | 12 month | 0% for your first loan; 6% after |

Qualifications and Documents:

| |||

14. First Circle Business Loan

First Circle Business Loan is a financial service in the Philippines designed to support the growth of small and medium enterprises (SMEs) by offering flexible, collateral-free loans. First Circle provides financing solutions that help businesses manage cash flow, purchase inventory, and take on larger projects without the long wait times of traditional bank loans. With a fast, fully online application process, First Circle aims to give entrepreneurs quick access to funds so they can seize business opportunities as they arise. By offering transparent terms and customized loan options, First Circle supports the expansion and sustainability of Filipino businesses.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| First Circle Business Loan | Up to ₱20 million | Up to 12 months | : 0.99% to 2.49% |

Qualifications and Documents:

| |||

15. GDFI Loans

Global Dominion Financing Inc. (GDFI) Loans offer a range of financial products in the Philippines aimed at meeting the diverse needs of individuals and businesses. Known for its accessible loan options, GDFI provides personal loans, business loans, car financing, and specialized loans for OFWs (Overseas Filipino Workers). With a focus on customer service and a straightforward application process, GDFI ensures that borrowers can access funds with minimal hassle. GDFI Loans are structured to support Filipinos in reaching financial goals, whether it’s starting a business, covering educational expenses, or managing daily cash flow.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| GDFI Loans | Starts at ₱10,000 | Starts at 12 months | Starts at 1% |

Qualifications and Documents:

| |||

16. Radiowealth Finance Company

Radiowealth Finance Company (RFC) Cash Loan is a financial solution offered in the Philippines, designed to provide quick cash assistance for various needs, such as personal expenses, business capital, and emergency funds. RFC offers flexible loan amounts ranging from ₱10,000 to ₱5,000,000, with repayment terms of up to 36 months. The cash loan features competitive interest rates, depending on the amount borrowed and the term chosen. For larger loan amounts, collateral such as real estate or vehicles may be required, which can result in lower rates and better terms. RFC’s Cash Loan is accessible to Filipino citizens aged 21 and above, making it an ideal option for individuals seeking financial support with flexible terms and a straightforward application process.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Radiowealth Finance Cash Loan | ₱10,000 to ₱5 million | Three to 36 months | Subject to the lender’s approval |

Qualifications and Documents:

| |||

17. Home Credit Cash Loan

Home Credit Cash Loan is a personal loan service in the Philippines that provides fast and easy access to cash for various financial needs. Available through the Home Credit app, this loan allows eligible borrowers to apply and get approved quickly without the need for collateral. It offers flexible loan amounts and repayment terms, making it a convenient option for emergencies, personal expenses, or purchases. With a simple application process and transparent fees, Home Credit aims to provide a reliable financial solution to Filipinos, helping them manage their cash flow and meet their financial goals.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Home Credit Cash Loan | ₱3,000 to ₱150,000 | Six to 60 months | Starts at 2.32% |

Qualifications and Documents:

| |||

18. JuanHand Online Cash Loan

JuanHand Online Cash Loan is a fast and accessible lending service in the Philippines that provides instant cash loans through its easy-to-use mobile app. Designed for individuals in need of quick financial assistance, JuanHand offers a straightforward online application process with quick approval and disbursement of funds. The platform offers flexible loan amounts and repayment terms to suit various financial situations, and it is known for transparent fees with no hidden charges. JuanHand aims to help Filipinos manage unexpected expenses or urgent needs with a hassle-free and reliable borrowing experience.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| JuanHand Online Cash Loan | ₱2,000 to ₱25,000 | Up to three months | 9% to 12% |

Qualifications and Documents:

| |||

19. Moneycat

MoneyCat is an online lending service that offers quick and easy loans to people who need money fast. It is designed for those who may not have access to banks or credit cards. With a simple online application, users can get small loans without much paperwork or credit checks. MoneyCat helps people cover urgent expenses with flexible repayment options.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Moneycat | ₱500 to ₱20,000 | Three to six months | 11.9% per month (maximum APR of 145%) |

Qualifications and Documents:

| |||

20. Online Loans Pilipinas

Online Loans Pilipinas is a digital lending platform that offers quick cash loans to individuals in the Philippines. The service provides easy access to funds through a simple online application, making it convenient for users who need money urgently. With minimal requirements and no need for collateral, borrowers can get small loans with flexible repayment terms. Online Loans Pilipinas aims to help people manage their short-term financial needs, such as emergency expenses or daily necessities.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Online Loans Pilipinas | ₱1,000 to ₱7,000 for first-time borrowers; up to ₱20,000 for repeat borrowers in good credit standing | 61 to 183 days | None for first-time borrowers; maximum APR of 143% |

Qualifications and Documents:

| |||

21. Tonik Credit Builder

Tonik Credit Builder is a financial product offered by Tonik, a digital bank in the Philippines, designed to help users build or improve their credit scores. It works by allowing customers to take a small, secured loan, which they repay over time. As they make timely payments, their credit history improves, making it easier for them to qualify for larger loans or other financial products in the future. Tonik Credit Builder is ideal for those new to credit or looking to repair their credit standing, offering a simple and effective way to boost financial health.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| Tonik Credit Builder | Up to ₱20,000 | Six, nine, and 12 months | Starts at 4.84% |

Qualifications and Documents:

| |||

22. BillEase

BillEase is a flexible financing platform in the Philippines that allows users to make purchases and pay later through easy installment plans. It offers a “buy now, pay later” service, enabling customers to split their payments into manageable monthly installments with low interest rates or even zero-interest options for select plans. BillEase is designed to make shopping more affordable and accessible, especially for those who may not have credit cards. Users can apply online, get approved quickly, and enjoy a hassle-free payment experience for their online and in-store purchases.

| Loan Provider | Loan Amount | Loan Term | Interest Rate |

| BillEase | Between ₱2,000 to ₱10,000 (initial) increased to ₱40,000 | 3-6 months | 3.49% monthly |

Qualifications and Documents:

| |||

Final Thoughts

Note that these online loans are suitable for emergency purposes only. Although these online loans are legitimate, ensure that you are able to grasp the concept of loan terms and interest rates of each. For clarifications, loan term is the allotted time given to you to pay the certain amount that you borrowed. As such, the interest rate is the fee charged on the principal amount you loaned depending on the loan term you availed. Lastly, please carefully read the terms and conditions set by the lenders to know if there are any hidden charges regarding your loan. Again, as they always say, prevention is always better than cure. Stay financially literate!

Read Also: Best Salary Loans in the Philippines to Help You With Urgent Financial Needs

Disclaimer: This article provides a list of online loan providers in the Philippines but should not be considered as financial advice. Readers are encouraged to conduct their own research and exercise caution when choosing lenders, as terms, fees, and eligibility requirements vary. The website does not guarantee the legitimacy or reliability of the lenders listed. Always review loan agreements thoroughly and consult a financial advisor if needed. This information is for general awareness, and the website is not liable for any financial decisions made by readers based on the content.