A promissory note is a legally binding document that outlines a borrower’s promise to repay a specific sum of money to a lender. This document is widely used in personal and business transactions to formalize loans and credit agreements.

Promissory note serves as an essential financial tool that provides clarity and security in loan agreements. By clearly outlining the terms of repayment, it minimizes disputes and misunderstandings between lenders and borrowers. Whether it is a secured or unsecured loan, having a written agreement ensures that both parties understand their obligations.

What is a Promissory Note?

A promissory note is a written promise to pay a debt under specified conditions. It includes essential details such as the amount borrowed, repayment terms, interest rate, and the due date.

Unlike a loan agreement, which involves more detailed terms and conditions, a promissory note is often simpler and more flexible. It is used in various financial transactions, including personal loans, business loans, real estate transactions, and even student loans.

Key Elements of a Promissory Note

A well-drafted promissory note should contain the following elements:

- Names and Addresses – The full names and contact details of the lender and borrower.

- Loan Amount – The principal amount borrowed.

- Repayment Terms – The schedule of payments, including frequency and due dates.

- Interest Rate – If applicable, the percentage of interest charged on the loan.

- Due Date – The final date for full repayment of the loan.

- Signatures – The signatures of both parties to confirm agreement to the terms.

- Collateral (if any) – Any asset pledged as security for the loan.

Types of Promissory Notes

There are different types of promissory notes, each catering to different financial needs:

1. Secured Promissory Note

A secured promissory note includes collateral, which the lender can claim if the borrower defaults.

2. Unsecured Promissory Note

An unsecured promissory note does not require collateral, making it riskier for the lender.

3. Demand Promissory Note

This type of note does not specify a repayment schedule; instead, the lender can demand payment at any time.

4. Installment Promissory Note

Repayment is made in periodic installments, making it easier for the borrower to manage payments.

5. Balloon Promissory Note

This note allows smaller payments initially, with a large lump-sum payment at the end of the loan term.

Uses of a Promissory Note

Promissory notes are commonly used in various financial scenarios, including:

- Personal Loans – Borrowing money from friends or family.

- Business Loans – Funding for startups or operational expenses.

- Real Estate Transactions – Down payments or property purchases.

- Education Loans – Student loan agreements between lenders and borrowers.

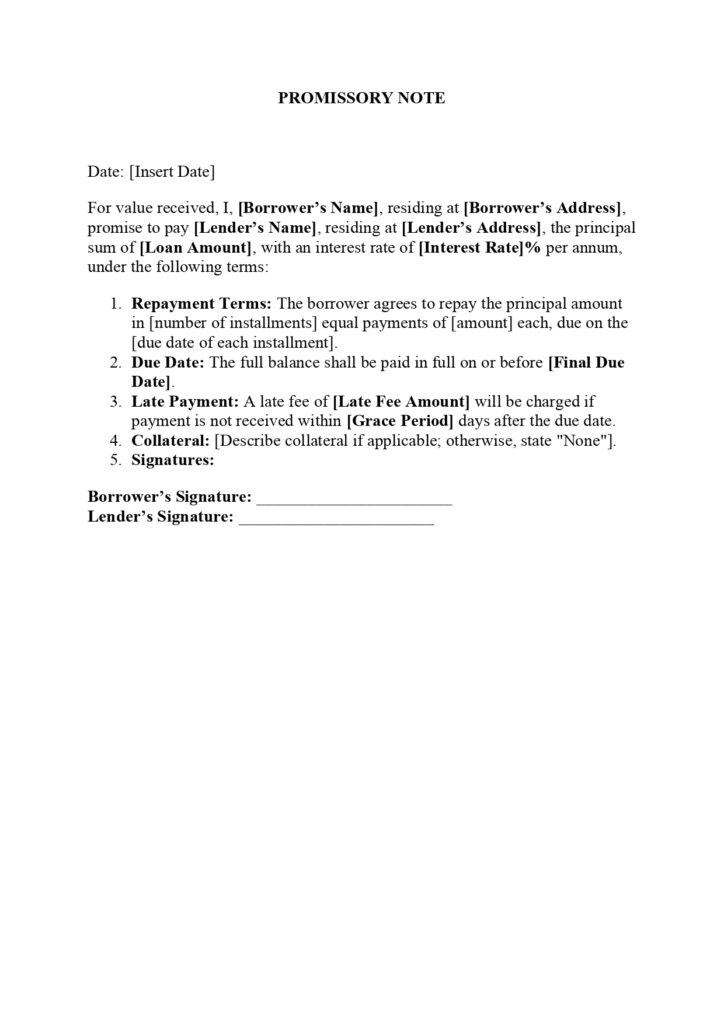

Sample Promissory Note

Here is a simple example of a promissory note:

PROMISSORY NOTE

Date: [Insert Date]

For value received, I, [Borrower’s Name], residing at [Borrower’s Address], promise to pay [Lender’s Name], residing at [Lender’s Address], the principal sum of [Loan Amount], with an interest rate of [Interest Rate]% per annum, under the following terms:

- Repayment Terms: The borrower agrees to repay the principal amount in [number of installments] equal payments of [amount] each, due on the [due date of each installment].

- Due Date: The full balance shall be paid in full on or before [Final Due Date].

- Late Payment: A late fee of [Late Fee Amount] will be charged if payment is not received within [Grace Period] days after the due date.

- Collateral: [Describe collateral if applicable; otherwise, state “None”].

- Signatures:

Borrower’s Signature: _______________________

Lender’s Signature: _______________________

Free Promissory Note Template

Below is a simple fill-in-the-blank template for your use:

PROMISSORY NOTE

Date: ________________

Borrower: [Your Full Name]

Address: [Your Address]Lender: [Lender’s Full Name]

Address: [Lender’s Address]Loan Amount: [Amount]

Interest Rate: [Rate]% per annum

Repayment Terms: [Installment Amount] per [Payment Frequency]

Final Due Date: [Date]

Late Fee: [Fee Amount] if payment is delayed by [Grace Period] days

Collateral (if any): [Describe]By signing below, both parties agree to the terms of this note:

Borrower’s Signature: ________________

Lender’s Signature: ________________

Final Thoughts

A promissory note is an essential financial document that helps ensure smooth loan transactions between parties. Whether for personal or business use, having a well-structured note can protect both the lender and borrower.

Furthermore, promissory notes offer a legally recognized format for repayment agreements, reducing the likelihood of misunderstandings. If you’re lending or borrowing money, using a clear and concise promissory note template can help avoid future complications and disputes.

Check Also:

- Excuse Letter | For Work & School | Tips, Format, and Sample

- Authorization Letter Sample and Template (Free Download)

- Formal Letter Format: The Ultimate Guide