Do you have an unsettled loan balance with the Social Security System (SSS) that you have not yet paid for over a month now or even years? Maybe, it has come to a point where it’s continuously mushrooming and you are having difficulties paying off your remaining balance. Consider your queries solved because SSS is now offering its member an opportunity to oblige with their unpaid balance without penalties and with agreeable installment terms! In this article, we’ve got you covered because we will explain the ways on how you can apply for an SSS loan condonation program online.

November 2021, when the SSS issued the Short Term Member Loan Penalty Condonation Program (STMLPCP), a part of the Pandemic Relief and Restructuring Program (PRRP) of the agency. The SSS loan condonation program under the Short-term loans include:

- Salary Loan

- Calamity Loan

- Salary Loan Early Renewal Program (SLERP)

- Emergency Loan

- Restructured Loan under the Loan Restructuring Program (LRP) implemented in 2016 to 2019.

With the help of the SSS loan condonation program, members will have the chance to fortify their loans and compel with their outstanding loan balance. Albeit, the principal and interest are still due and payable, the penalties incurred will be tolerated or waived. Members can choose between a one-off payment or monthly installments for six months.

Good news! You don’t have to visit an SSS branch to apply for the SSS loan benefit because it’s just several taps away from your computer and mobile phone. You just need an active My.SSS account. After completing the submission and approval of your credit benefit application, you must pay your fortified or reorganized loan within the required payment period, which will be within 30 days for a one-off payment and monthly installments for six months.

The deadline for filing of applications for Restructuring and Condonation of loans under the Pandemic Relief and Restructuring Program (PRRP) has been Extended.

- Housing Loan Restructuring and Penalty Condonation Program (PRRP 4) – Extended to May 21, 2022

- Short-Term Member Loans Penalty Condonation Program (PRRP 5) – Extended to May 14, 2022

Who Qualifies for the SSS Loan Condonation Program?

The Short Term Member Loan Penalty Condonation Program (STMLPCP) is open to the following SSS members:

- Member-borrowers who have unsettled payments for at least six (6) months at the start of the condonation period;

- Members who are under the age of 65 at the end of the installment term (for installment payment)

- Members who have not been disqualified due to SSS fraud;

- Member-borrowers whose contingency date is on or before the last day of the SSS loan condonation program’s availment period upon the filing of their last benefits application for retirement or permanent total disability. During the availment period, the final benefit claim must be lodged; and

- Death benefit applications filed by heirs and beneficiaries of deceased member-borrowers whose contingency date is on or before the last day of the loan condonation program’s availment period. During the availment period, a death benefit claim must be lodged.

Step-by-Step Procedure in Applying for SSS Loan Condonation Online

All SSS member-borrowers must apply for loan penalty condonation through their My.SSS account on the SSS website. Members with death, disability, or retirement claims must ask for loan condonation at SSS branches over the counter.

STEP 1: Login to your My.SSS account.

Log in to your account on the My.SSS member site using your browser. If you don’t have a My.SSS account, follow the instructions on this page to create one.

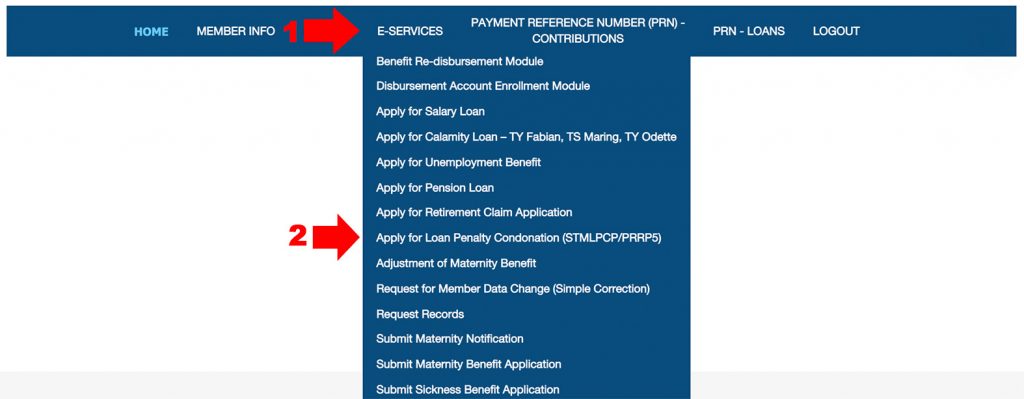

Step 2: Request a Loan Penalty Waiver.

Once you’ve logged into your My.SSS account, go to “E-SERVICES” and select “Apply for Loan Penalty Condonation (STMLPCP/PRRP5)” from the dropdown menu.

You’ll be directed to the application page for the Short-Term Member Loan Penalty Condonation Programs (STMLPCP). You can see your aggregated loan details and statement of loan balances on this page.

Step 3: Decide on a payment term that works best for you.

The third step is to decide whatever payment term you want to use. The default payment term is “One-Time Payment,” however you can pay your SSS loan in monthly installments by selecting “Installment” from the dropdown field for “Preferred Term.”

SSS members who have reached the age of 65 or who will reach 65 in the following six months are only eligible for a one-time payment.

If you want to pay by installment, you will be asked to make a 50 percent down payment on your consolidated loan. Even if the needed payment is made within the 30-day period, partial or staggered installments of the aggregated loan amount are not permitted. The 50 percent downpayment must be paid in one lump sum.

Starting the month after the 30-day downpayment period, the remaining 50% of the loan amount or the restructured loan will be paid in six (6) equal monthly payments. The restructured loan is subject to a 3% annual interest rate calculated on a decreasing principal balance over the course of the 6-month payment term.

After the restructured loan’s due date, a penalty of 1% per month will be applied to any outstanding amortizations during the 6 months payment term.

Step 4: Read over your application and submit it.

Take the time to check your SSS loan condonation application, including the details of your payment, after you’ve chosen your payment period. Takedown your payment information, including the loan amount, the amount due, the terms in days or months, and the due date.

Loan Consolidation (One-Time Payment or 50 percent Downpayment)

Loan Amount– The total amount of your loan is referred to as the loan amount (or the 50 percent downpayment if payable through installment).

Amount Due– The amount you must pay before the due date is known as the amount due.

Terms in Days– The number of days you have to pay back your consolidated loan

Due Date– The last day or deadline to pay your loan is known as the due date.

Condonable Penalty – The loan penalty amount that will be tolerated or forgiven after the consolidated debt is paid in full.

Loan Restructuring (50 percent Installment)

Remaining 50% Loan Amount– The remaining 50% loan amount is the total loan amount that must be paid in installments.

Monthly Due– The amount that must be paid on a monthly basis.

Terms in Months — The number of months you have to pay back your restructured debt.

First Amortization Month– The month in which your amortization begins is known as the first amortization month.

First Amortization Due Date– The deadline to pay your first monthly amortization is the first amortization due date.

Last Amortization Due Date — This is the date by which you must pay your last monthly amortization.

Interest Rate P.A – The annual interest rate (year) calculated on a decreasing principal balance.

Condonable Penalty – The amount of the loan penalty that will be forgiven or condoned after the restructured debt is paid in full.

Take the time to read the Terms & Conditions as well as the Promissory Note, all of which may be accessed by clicking the plus (+) icon. After your application has been approved, you will receive these materials by email.

Finally, read the section on Certification and Undertakings before clicking “AGREE.”

“Are you sure you want to submit this Short-Term Member Loan Penalty Condonation Application?” a popup will ask. ”

To continue with your application, click “SUBMIT.” Click “CANCEL” if you’ve changed your mind, and your application will not be submitted.

Step 5: Your Loan Condonation Request Has Been Accepted

Congratulations! If everything goes according to plan, your SSS loan condonation application will be approved right away. Read the Notice of Approval carefully before clicking “CONFIRM.”

Click “PRN – LOANS” on the main menu bar to see your payment reference number (PRN), amount due, and due date. When paying your SSS loan through SSS-approved payment partners and online payment apps like GCash, use your PRN.

You’ll also get an email with documentation related to your SSS loan condonation application, such as the terms and conditions, promissory note, statement of loan balances, and approval notification. If you have any queries concerning your application for SSS loan condonation, consult these documents or log into your My.SSS account.

READ: How to Pay SSS Loan Condonation Online

Frequently Ask Questions

Who are qualified for loan condonation?

Loan condonation is available to SSS members with past due short-term loans that have been delinquent for at least six (6) months as of the start of the condonation periodSimply login to your My.SSS account and click “E-SERVICES” and then “Apply for Loan Penalty Condonation (STMLPCP/PRRP5)” to see if you’re eligible for the SSS loan condonation program.

Is it possible to reapply for SSS loan condonation even if my previous application was denied?

Yes. If you were unable to pay the full amount of your consolidated loan or a 50% downpayment (for installment term) and your application was denied, you may reapply for debt condonation on or before the due date.

Good day!

I do not know my user ID

My salary loan posible for condonation this feb

For long time i can not to pay my salary loan

Good morning!

As much as I would like to apply for the Restructuring Program but unfortunately I could not log in in my sss account, it says it’s unavailable.

Please acknowledge receipt of this email

Thank you very much

Napaka hirap po pumasok sa online registration…HELP US PO!

Can i cancel my approved loan condonation?