PhilHealth is a government-mandated health insurance program that provides affordable and accessible healthcare services to Filipinos. As part of its commitment to universal healthcare, PhilHealth regularly adjusts its contribution rates to maintain sustainable funding for medical benefits. For 2025, the contribution rate has been set at 5.0% of the monthly salary or declared income, with corresponding updates to the minimum and maximum contribution levels. These changes aim to support the growing demand for healthcare services while ensuring that members from all income brackets receive adequate medical coverage.

Understanding the latest contribution rates and how they apply to various categories of PhilHealth members is crucial for individuals and employers alike. Whether you’re employed, self-employed, an overseas Filipino worker (OFW), or a voluntary member, knowing the required premiums and deadlines helps you stay compliant and continuously enjoy PhilHealth’s comprehensive benefits. In this guide, we’ll explore the updated contribution table for 2025 and explain how the rates affect different member types.

First and foremost, members should be aware of how much they need to contribute to PhilHealth. Why? Because this can ensure that your PhilHealth account stays active.

Read: How to Check PhilHealth Contribution Online

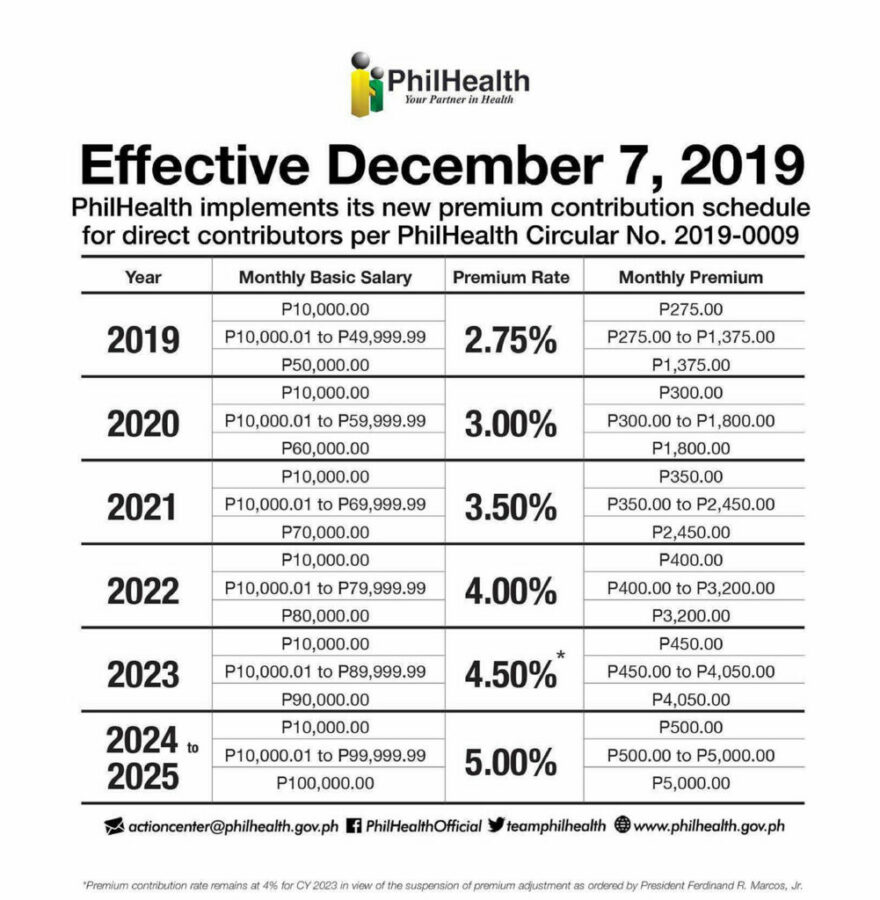

Updated PhilHealth Contribution Table 2025

Take note that the membership category will be applied to those who have formal contracts and fixed terms of employment. If you are a member of PhilHealth, regardless if you work for the government or not, you will share the same premium.

1. For Employed Members (Private and Government Employees)

- Contribution Rate: 5.0% of the employee’s monthly basic salary

- Salary Floor: ₱10,000

- Salary Ceiling: ₱100,000

Computation:

- The total monthly premium is based on the employee’s monthly salary.

- The employer and employee share the contribution equally (50% each).

| Monthly Basic Salary | Monthly Premium | Employee Share | Employer Share |

|---|---|---|---|

| ₱10,000 and below | ₱500 | ₱250 | ₱250 |

| ₱20,000 | ₱1,000 | ₱500 | ₱500 |

| ₱50,000 | ₱2,500 | ₱1,250 | ₱1,250 |

| ₱100,000 and above | ₱5,000 | ₱2,500 | ₱2,500 |

2. For Self-employed, Voluntary Members, and Professionals

- Contribution Rate: 5.0% of declared monthly income

- Income Floor: ₱10,000

- Income Ceiling: ₱100,000

Computation:

- The monthly contribution is based on the member’s declared monthly income.

- The contribution is paid in full by the individual.

| Monthly Income | Monthly Premium |

|---|---|

| ₱10,000 and below | ₱500 |

| ₱20,000 | ₱1,000 |

| ₱50,000 | ₱2,500 |

| ₱100,000 and above | ₱5,000 |

3. For Overseas Filipino Workers (OFWs)

- Contribution Rate: 5.0% of monthly income or the income floor of ₱10,000 (whichever is higher).

- Annual Premium: Minimum of ₱12,000 and a maximum of ₱54,000 per year (based on income level).

Payment Options

- OFWs may pay their contributions annually or semi-annually through accredited payment centers, including overseas remittance centers and PhilHealth partners like banks and e-wallets.

4. For Kasambahays (Household Workers)

- Contribution Rate: 5.0% of monthly salary.

- If the kasambahay’s monthly salary is ₱5,000 or below, the employer pays the full contribution.

| Monthly Salary | Monthly Premium | Employer Share | Kasambahay Share |

|---|---|---|---|

| ₱5,000 and below | ₱250 | ₱250 | ₱0 |

| ₱10,000 | ₱500 | ₱250 | ₱250 |

5. For Senior Citizens

- No premium contributions required for senior citizens under Republic Act No. 10645, which automatically enrolls them into PhilHealth’s program.

6. Lifetime Members

- No further premium contributions required for members who have paid at least 120 months of contributions during their working years.

7. Indigent and Sponsored Members

- Premiums are fully subsidized by the government under the National Health Insurance Program (NHIP).

Payment Deadlines

- Employed Members: Contributions are automatically deducted and remitted by the employer on or before the 10th day of the following month.

- Self-employed/Voluntary Members: Contributions can be paid quarterly, semi-annually, or annually.

- OFWs: Contributions are due based on the chosen payment schedule (annual or semi-annual).

Key Changes in 2025 PhilHealth Contributions

- The contribution rate has increased to 5.0%, with the salary/income ceiling now set at ₱100,000.

- The minimum monthly contribution is ₱500, while the maximum is ₱5,000.

- These adjustments ensure that PhilHealth continues to provide adequate coverage for members while expanding its benefits packages.

How to Pay PhilHealth Contributions

Paying PhilHealth contributions is an essential responsibility for both employed and voluntary members to ensure continuous health insurance coverage. There are different payment methods depending on whether you are an employee, self-employed, or an Overseas Filipino Worker (OFW). Here’s a guide on how to pay your PhilHealth contributions:

1. For Employed Members

For employees working in both public and private sectors, the process is handled by the employer:

- Automatic Deduction: Employers are responsible for deducting the employee’s share of the PhilHealth premium from their salary. The total contribution (employee and employer shares) is then remitted by the employer.

- Payment Deadline: Employers must remit the PhilHealth contributions on or before the 10th day of the following month.

- Payment Channels: Employers can remit contributions through accredited payment centers, such as:

- PhilHealth Partner Banks: Landbank, UnionBank, and other accredited banks.

- Over-the-counter Payments: Some employers can also pay through payment partners like Bayad Centers or SM Business Centers.

Employers must also submit a PhilHealth Employer Remittance Report to document the payments made on behalf of their employees.

2. For Self-employed, Voluntary Members, and Professionals

Voluntary members, including self-employed individuals and freelancers, are responsible for paying their own PhilHealth contributions. Here are the steps:

Online Payment via PhilHealth Member Portal:

- Access the PhilHealth Member Portal.

- Log in using your PhilHealth Identification Number (PIN) and password.

- Select the payment management option, choose your payment schedule (monthly, quarterly, semi-annual, or annual), and generate the Statement of Account (SOA).

- You can pay through:

- Online banking (via Landbank or UnionBank)

- E-wallets like GCash or PayMaya

Payment Centers:

- You can also pay your contributions at Bayad Centers, 7-Eleven, SM Payment Centers, Western Union, or PhilHealth-accredited collecting agents.

- Payments can be made monthly, quarterly, semi-annually, or annually.

Payment Breakdown:

- Quarterly: 3 months’ worth of contributions.

- Semi-annual: 6 months’ worth of contributions.

- Annual: 12 months’ worth of contributions.

3. For Overseas Filipino Workers (OFWs)

OFWs can pay their PhilHealth contributions either while abroad or upon return to the Philippines. Here are the options:

- PhilHealth Partner Remittance Centers: OFWs can remit contributions through accredited overseas remittance centers, including:

- iRemit, Ventaja, SkyFreight, and Cebuana Lhuillier

- Overseas branches of Landbank, DBP, or other PhilHealth-accredited banks

- PhilHealth Member Portal: OFWs can also pay through the online portal using the same procedure as voluntary members.

- E-wallets and Local Payment Centers: When in the Philippines, OFWs can use GCash, PayMaya, or local payment centers to make their contributions.

- Payment Period: OFWs can opt for annual or semi-annual contributions to ensure continuous coverage while working abroad.

4. For Kasambahays (Household Workers)

- Employer Responsibility: For household workers (kasambahays), if their salary is ₱5,000 or below, the employer is required to shoulder the full contribution. If the salary exceeds ₱5,000, the contribution is shared between the kasambahay and the employer.

- Payment Process: The employer pays the contributions through PhilHealth partner banks, e-wallets, or accredited payment centers.

5. For Senior Citizens and Lifetime Members

- No Contributions Required: Senior citizens and lifetime members do not need to make contributions as they are automatically covered under PhilHealth. The government subsidizes their premiums.

By regularly contributing, PhilHealth members ensure that they have access to health benefits and financial protection during times of illness or medical emergencies.

More Philhealth Guides and Tips

- How to check Philhealth beneficiaries online

- How to get Philhealth Member Data Record (MDR) Online

- How to process Philhealth papers for hospitalization benefits

Ask ko Lang po Kung pwede ko pa bayaran ung month of July to September?